Price band set at ₹267/- to ₹281/- per share

Allied Blenders and Distillers (ABD) much awaited IPO opens on 25th June 2024 with the price band fixed of ₹267/- to ₹281/- per Equity Share of face value ₹2/- each. The IPO closes 27th June, 2024 with the investors can bid for a minimum of 53 Equity Shares and in multiples of 53 Equity Shares thereafter.

The IPO consists of fresh issue of up to Rs 1,000 crore and an offer for sale (OFS) of up to Rs 500 crore by Promoters.

The proceeds from the fresh issue will be utilised to the extent of Rs. 720 crore for prepayment or scheduled re-payment of a portion of certain outstanding borrowings availed by the company and general corporate purposes.

The Mumbai-based ABD is the third largest IMFL company in India, in terms of annual sales volumes between Fiscal 2014 and Fiscal 2022 and also one of the only four spirits companies in India with a Pan-India sales and distribution footprint, and is a leading exporter of IMFL, with an estimated market share of 11.8% in the Indian Whisky market for fiscal 2023.

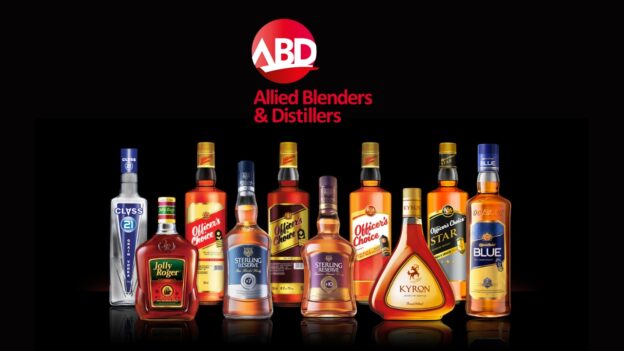

The Company started its journey in 1988 with the launch of flagship brand, Officer’s Choice Whisky which marked their entry into the mass premium whisky segment. From 2016 to 2019, Officer’s Choice Whisky was among the top-selling whisky brands globally in terms of annual sales volumes. Over the years, ABD has expanded and introduced products across various categories and segments.

As of 31st December, 2023, their product portfolio comprised 16 major brands of IMFL across whisky, brandy, rum, and vodka. ABDs brands which includes Officer’s Choice Whisky, Sterling Reserve, ICONiQ Whisky and Officer’s Choice Blue, are ‘Millionaire Brands’ or brands have sold over a million 9-liter cases in one year. As of 31st March, 2023, their products were retailed across 79,329 retail outlets across 30 States and Union Territories in India.

ICICI Securities Limited, Nuvama Wealth Management Limited, and ITI Capital Limited are the book running lead managers and Link Intime India Private Limited is the registrar to the offer. The equity shares are proposed to be listed on BSE and NSE. The Offer is being made through the Book Building Process, wherein not more than 50% of the Offer shall be available for allocation to Qualified Institutional Buyers, not less than 15% of the net offer shall be available for allocation to Non-Institutional Bidders and not less than 35% of the Offer shall be available for allocation to Retail Individual Bidders.