The success story of Indian Single Malt (ISM) whisky in the global market place, pioneered by Bengaluru-based Amrut Distilleries, has been well documented. It is not only an interesting story, but also an inspiring one on how the Jagdales – father-son duo – the late Neelakanta Rao Jagdale and Rakshit Jagdale – hit upon the idea of making a breakthrough in the whisky landscape, dominated by Scotland.

Rakshit Jagdale, in a podcast ‘Expert Talk with Bhavya Desai’ recalls his student days at Newcastle University doing an intense one-year MBA programme. “It was a Sunday morning and I was strolling along Northumberland street, a busy shopping center in New Castle upon Tyne, when my father called up and asked what I was planning to do for my thesis. I said a theoretical project on supply chain management. He said ‘no, no… you should do a practical project’ and suggested ‘why don’t you check whether there is scope to sell Indian single malt whisky in Indian restaurants within Great Britain’ stating that Kingfisher and Cobra beers were quite popular in Indian restaurants there. My father asked me to check out whether there was demand for Indian single malt as an aperitif or a digestive. I said it’s a brilliant idea.”

Miniatures that captured the imagination

Neelakanta Rao Jagdale then sat down with the excise officials in Karnataka and had two cases of miniatures of single malt whisky sent over to New Castle. “It was in June when exams were going on. I went over to the Customs bond and duty paid and cleared one case. The packaging was very rudimentary with a black and white label with simple words ‘Amrut’. We knew our product was exceptionally good. The colour of the whisky was good, dark enough and natural. We don’t add any caramel, it is 100% natural. My father had sent 300 miniatures of 60 ml each in two boxes. It was a live project for the company. I did a lot of my survey in New Castle, Edinburgh in Scotland and in the Midlands. I visited several Indian restaurants and bars in Scotland and the response was amazing. Everybody liked it. Some said it’s a 10-year old whisky, some said its Irish, when I said it was Indian, it was a jaw dropping moment.”

On returning to India, Rakshit presented the project to the family board. “It took us two years to conform to the packaging standards of the European Union and on August 24, 2004, we launched Amrut in Café India in Glasgow. That is how the journey of Indian Single Malt whisky began.”

Making the Grade in Whisky Bible

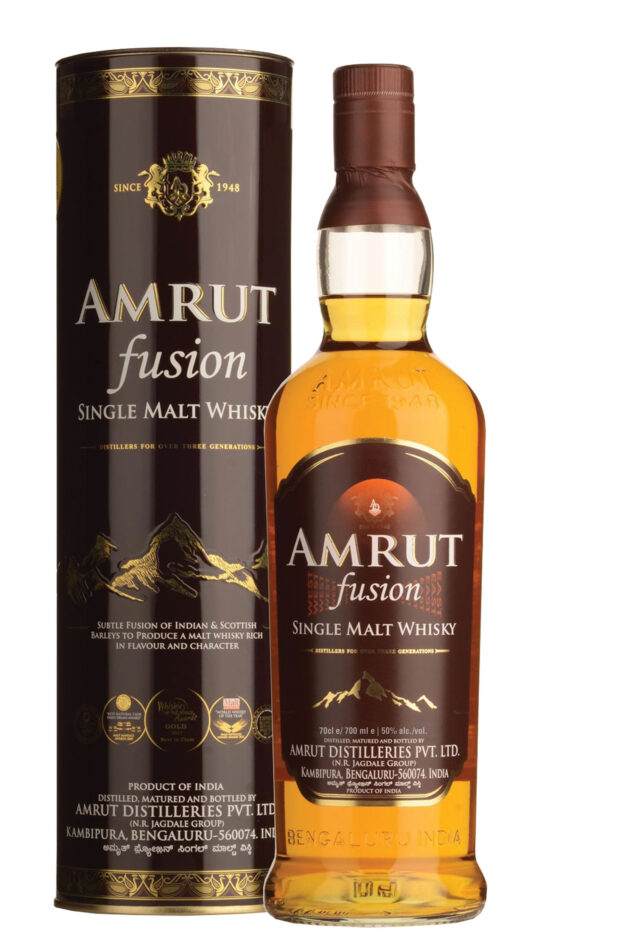

Not to sit on these laurels, they set off on taking it to the world, creating Amrut Fusion which was next level to the Classic Indian Amrut. “Fusion is a completely different product. It is a combination of peated barley and unpeated barley, the former coming from Scotland and the unpeated from India. It is an 80:20 ratio. My father felt that as the Indian palate is accustomed to little bit of peat with Johnnie Walker Red Label and Black Label, they would like the combination. That was running in his mind.”

Explaining the process, Rakshit mentioned, “Fusion is matured for a longer period, five to five and a half years. The base malt, both peated and unpeated, is matured for four years and then we marry them and mature it again for nine months to one year, which gives it not only depth, but also complexity of flavours. When Jim Murray first savoured it in 2009 and found it unique and said there was no other product in the world that had this kind of combination. He loved Amrut and gave 97 of 100 in his Whisky Bible in 2010 and ranked it as the third finest whisky in the world.”

From humble beginnings in 1948 as a simple bottling company, Amrut is a name to reckon with. It moved on early into distillation and premiumisation and that has paid dividends. “We have reasonably come a long way. We have grown organically and we are happy with progress we have made.”

This is the third generation of the Jagdale family which is running the business, started by Radhakrishna Rao Jagdale in 1948. The fourth generation is getting ready and Rakshit mentions that ‘the time is right to discus with his son and niece to find out if they have any interest, prima facie, in carrying forward the rich legacy of my grandfather and father.”