Indian-made foreign liquor (IMFL) maker Allied Blenders and Distillers (ABD) has received final observation from the capital markets regulator, Securities and Exchange Board of India (SEBI), to raise Rs 1500 crore through an initial public offering (IPO). The Company had refiled its IPO papers with Sebi on January 15, 2024.

The shares are offered at a face value of Rs 2 and is a mix of fresh issue of up to Rs 1000 crore and an offer for sale of up to Rs 500 crore by Promoters and Promoter Group. The offer for sale comprises up to Rs 250 crore by Bina Kishore Chhabria, Rs 125 crore by Resham Chhabria Jeetendra Hemdev and Rs 125 crore by Neesha Kishore Chhabria. It also includes a reservation for subscription by eligible employees. The proceeds from its fresh issuance to the extent of Rs 720 crore will be utilized for prepayment or scheduled re-payment of a portion of debt and for general corporate purposes.

A press release from the company said that in consultation with the book-running lead managers, it may go for a preferential issue or any other method for a consideration aggregating up to Rs 200 crore as “Pre-IPO placement”. If such placement is completed, the issue size will be reduced.

ABD’s brand Officer’s Choice Whisky in the mass premium segment has a market share of 11.8% in Fiscal 2023 in the Indian whisky market, highlighting their strong position as a leading exporter of IMFL.

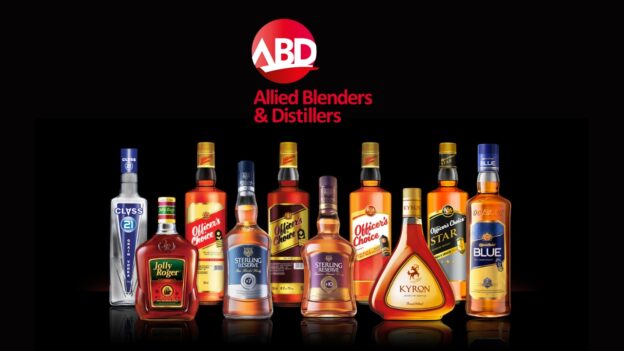

Over the years, ABD has expanded and introduced products across various categories and segments. Allied Blenders and Distillers have successfully leveraged their strength in the popular segment to launch successful brands in both prestige and premium segments. The company has shifted its focus from mass whisky segment to premiumization, with the launch of brands like ICONiQ White Whisky, Srishti Whisky, and X&O Barrel Whisky.

ICONiQ White Whisky touched 2 million cases in its first year of launch. Additionally, in January 2024, ABD introduced Zoya Special Batch Premium Gin, further expanding their product offerings beyond whisky.

The Company has a nationwide sales and distribution network spanning 30 states and union territories, with products available in 79,329 outlets. As of August 31, 2023, their product portfolio comprised 17 major brands of IMFL across whisky, brandy, rum, and vodka.

ICICI Securities Limited, Nuvama Wealth Management Limited, and ITI Capital Limited, are the book-running lead managers, and Link Intime India Private Limited is the registrar of the offer. The equity shares are proposed to be listed on the BSE and NSE.