• Prime Minister, Narendra Modi calls the pact ‘historic milestone’

• UK Prime Minister, Keir Starmer believes it would strengthen alliances and reduce trade barriers

• Scotch whisky and gin tariff reduced from 150% to 75%

• Indian alcobev industry hopes ‘minimum import price’ and non-tariff barriers are addressed

• Radico Khaitan to import `250 crore worth of Scotch in Fiscal Year 2025-26, expects substantial cost-benefit

After protracted negotiations from January 2022, India and the United Kingdom finally signed the ‘Free Trade Agreement’ on April 6. The Indian Prime Minister, Narendra Modi has termed it as a ‘historic milestone’, while his UK counterpart Sir Keir Starmer said that strengthening alliances and reducing trade barriers with economies around the world is part of their ‘Plan for Change’ to deliver a stronger and more secure economy.

The FTA signing announcement came following a telephonic conversation between Prime Minister Modi and his UK counterpart Starmer. The pact was signed in London by the Indian Commerce Minister, Piyush Goyal and the UK Trade Secretary, Jonathan Reynolds. The FTA covers 90% of tariff lines and includes tariff cuts on Scotch whisky, gin, automotive exports, medical devices, and machinery.

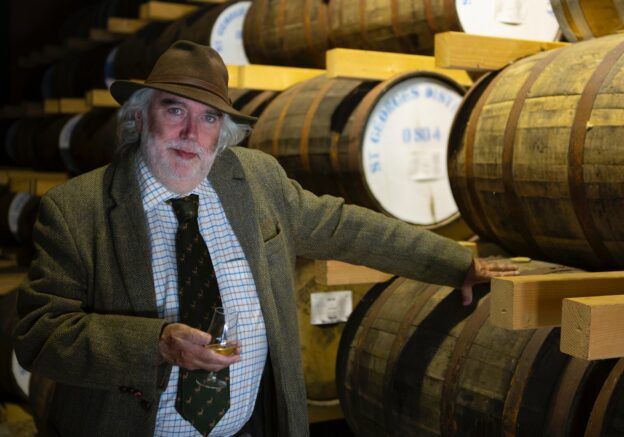

Scotch Whisky Tariff Halved

The Scotch whisky industry has been seeking reduction in tariff and that has been halved from 150% to 75% at entry into force, following to 40% after 10 years.

It must be mentioned here, recently India had reduced the tariff on American whiskey (bourbon) from 150% to 100%. India is likely to see now more of imported whiskies, predominantly Scotch as Indians love the dram.

Automotives down from 100% to 10%

The UK Department for Business and Trade (DBT) said that besides whisky and gin, tariff reductions have also been achieved on products such as medical devices, advanced machinery and lamb. Automotives has had the biggest tariff reduction from 100% to 10%. DBT said that the reduction of tariffs would be worth over 400 million pounds based on 2022 trade statistics and is expected to double to 900 million pounds by 2035.

“By striking a new trade deal with the fastest-growing economy in the world, we are delivering billions for the UK economy and wages every year and unlocking growth in every corner of the country, from advanced manufacturing in the North-East to whisky distilleries in Scotland,” said Trade Secretary Reynolds.

PM Modi’s Tweet

Prime Minister Modi tweeted “Delighted to speak with my friend PM Keir Starmer. In a historic milestone, India and the UK have successfully concluded and ambitious and mutually beneficial Free Trade Agreement, along with a Double Contribution Convention. These landmark agreements will further deepen our Comprehensive Strategic Partnership, and catalyse trade, investment, growth, job creation, and innovation in both our economies. I look forward to welcoming PM Starmer to India soon.”

Both agreed that the landmark agreements between the two big and open market economies of the world will open new opportunities for businesses, strengthen economic linkages, and deepen people-to-people ties.

The two leaders agreed that expanding economic and commercial ties between India and the UK remain a cornerstone of the increasingly robust and multifaceted partnership. The conclusion of a balanced, equitable and ambitious FTA, covering trade in goods and services, is expected to significantly enhance bilateral trade, generate new avenues for employment, raise living standards, and improve the overall well-being of citizens in both countries. It will also unlock new potential for the two nations to jointly develop products and services for global markets. This agreement cements the strong foundations of the India-UK Comprehensive Strategic Partnership, and paves the way for a new era of collaboration and prosperity.

The talks between the two nations have been going on since January 2022 and the signing gains importance in the backdrop of the tariff war initiated by the US President Donald Trump. Between 2022 and now, Britain has seen four different Prime Ministers, including the previous PM Rishi Sunak, involved in the negotiations.

INDUSTRY REACTIONS

Sudden and steep reduction, impacts Indian alcobev sector: Deepak Roy

However, the Confederation of Indian Alcoholic Beverage Companies (CIABC) while welcoming the cut in tariffs said it should have been gradual.

The Chairman of CIABC, Deepak Roy said the reduction from 150 to 75% is ‘sudden and steep’ which should have been gradual as the Indian alcobev sector is going through difficult times, besides operating in a highly regulated market.

“The Indian single malts, the gins and others are doing well, but we needed another couple of more years to make them really competitive in the global market.”

He said CIABC is hoping that non-tariff barriers are addressed in the FTA. “We had proposed a minimum import price of 50 to 75$ per case to ensure that there is no dumping of cheap and unknown products.”

Roy added that it was time for some of the State Governments to withdraw the excise duty concessions given to multinational corporations. “There should not be any difference and there should be a level playing field.”

While stating “We are not against any tariff reduction. The Indian industry is ready to compete with the global best and they are holding their own. Only thing, we do not want unknown cheap brands coming and killing the industry here which is providing substantial revenues to the State governments.”

CIABC hopes for ‘Minimum Import Price’: Anant Iyer

The Director General of the Confederation of Indian Alcoholic Beverage Companies (CIABC), Anant S. Iyer said, “Though FTA details are still awaited, from what information we have gathered it seems that the Government has not fully heeded to the pleas of the Indian alcoholic beverage industry.

We have always been asking for a level-playing field for the Indian players. We only hope that the government has included in the FTA the minimum import price (MIP) which will prevent dumping / under invoicing and also the removal of non-tariff barriers to ensure better international market access to Indian alcoholic beverages.

“We fear that if the same template of duty reduction is followed for the trade deals with the EU, the US and other nations which produce spirits and wines, then the Indian Alcobev industry, including the wine sector, could get adversely impacted.”

CIABC has urged the Government of India, as pointed out earlier also to various states such as Maharashtra, Kerala, Odisha, Rajasthan, Madhya Pradesh etc., to review the excise concessions given to imported liquor, both spirits and wines. “The governments should make them equal to that of IMFL / Indian wines. This discrimination should end immediately.”

He added, “The government is looking to touch $1 billion exports from the Indian Alcobev industry by 2030. However, without ensuring proper market access especially to the Western nations, it will be difficult to meet the export target. While the other sectors might be benefitting from the FTA, the Indian Alcobev industry seeks similar benefit. Though Indian whiskies, rum and gins have been winning accolades globally, without removal of non-tariff barriers and granting of market access it will be difficult for the Indian Alcobev sector to meet the export target.”

Suntory’s Neeraj Kumar calls its ‘pivotal development’

Neeraj Kumar, Managing Director, Suntory Global Spirits India terming it a ‘historic milestone’, welcomed the decision to reduce tariffs on whisky and gin. “This is a pivotal development that will improve access, affordability, and consumer choice in India. It also marks a positive step in strengthening bilateral trade ties and fostering an environment for enhanced investment, innovation, and growth. The team at Suntory Global Spirits looks forward to unlocking new opportunities for collaboration and growth across both markets.”

Positive Shift for India’s Alcobev Sector: Abhishek Khaitan

The Managing Director of Radico Khaitan, Abhishek Khaitan while extending his congratulatory messages to the Prime Minister and the Minister of Commerce said, “This is a welcome move that signals a positive shift for India’s alcobev sector, particularly for companies on a premiumisation journey and those which are producing world-class spirits.

“As the largest importer of Scotch whisky for blending, Radico sees significant potential for cost advantages through the expected reduction in customs duties. Radico plans to import scotch malt worth ₹250 CR in fiscal year 2025-2026, and this treaty therefore benefits us substantially.

“Overall, this agreement creates a win-win opportunity for Indian companies striving to take India to the global stage with excellence and innovation.”

Hope Indian Single Malts will not dilute premium image: Amar Sinha

The Chief Operating Officer of Radico Khaitan, Amar Sinha termed it as a ‘landmark’ pact that was ‘long overdue’.

“India is transforming and we as a country are producing world class spirits and constantly upgrading our quality. To produce this quality of spirit, obviously we need to import spirits for blending which India does so far as vatted malt Scotch is concerned from Scotland.

“Radico as a company are the largest importers of vatted malt Scotch. This fiscal year 2025-26, Radico plans to import scotch worth ₹250 crores. With this FTA, Radico is going to get substantial benefit on the cost front which will make the company healthier and more profitable. So, we personally think as a company that it’s a great agreement and it will offer great opportunities for Indian companies to continue their premiumisation drive and keep reducing their cost.”

Sinha, however, added, “As far as Indian single malts (ISM) are concerned Radico produces ISM which are today acknowledged as one among the top 10 spirits of the world. Rampur ISM is one among top whiskies from India. We have priced our product pretty high and we believe in pricing our product much higher than what competition does. So, we are not weary of the fact what the competition does to its price. We feel that competition if it reduces price, they will be diluting the image of their premium brand, therefore we don’t think they will reduce price. It would be an opportune moment for foreign companies to make some money through this tax reduction.”

It is a very welcome move and a win-win situation for the UK as well as India, he said and added that the demand of India to look into non-tariff barriers is genuine. “We are waiting for the fine print of the FTA, before that it is difficult to comment.”

‘Short-term impact’ on Indian products: Paul John

The Chairman of John Distilleries, Paul. P. John while welcoming the FTA said, “We believe this to be a significant step towards strengthening bilateral trade and economic cooperation between the two countries. This may have a short term impact on Indian products however we are confident about the quality of our products. We also hope that that this deal will allow better ease of business for Indian products in the UK. It is also crucial to ensure that both nations maintain a level playing field, safeguarding the interests of domestic industries and promoting fair competition.”

Three-year maturation period contentious issue: Vinod Giri

The Director General of Brewers Association of India, Vinod Giri who has championed the cause of the spirits industry earlier, said, “We are yet to see what India gets in return and how the non-tariff issues are handled – especially the condition of three-year maturation to qualify as whisky and measures to prevent predatory pricing.

“In terms of impact Scotch makers are expected to improve their margins first by adjusting duty savings in invoice prices and if that happens, market dynamics will remain unchanged in short terms. Companies importing raw material for blending with domestic whiskeys in India will make some savings on cost.

“The most important long-term impact will be on BII (bottled in India) category. As duties start falling, the rationale for that segment will go away.”

About 30% reduction in retail price, avers Ajay Srivastava

Ajay Srivastava, the Founder of Global Trade Research Initiative and who was earlier part of negotiations with Australia said, “it’s a good decision and trade would increase between the two countries across sectors.”

While stating that as details of the FTA were still not available it would ‘difficult to hazard a guess’ on what the minimum import price would be, Srivastava said but added that “it will only be on the higher side, unlike wine which is around 4 dollars. Scotch always sells at a premium.”

Srivastava said the question that needs to be asked is how much would be the retail price be following the duty reduction. Giving a hypothetical scenario, he said if a bottle of Scotch whisky is 100$ and the duty at 150% and average State government duties is 60%, the consumer will be buying at $400. Now with the tariff halved from 150 to 75%, the consumer will pay 275$ which is almost 30% reduction. It is a good deal and people are anyways willing to pay for Scotch.”

On whether the Indian spirits market would be impacted, Srivastava asked “Is any Indian company producing Scotch. Nobody is in the bulk business. The Indian single malt is a niche market and does not compete with Scotch. Yes, Indians love Scotch.” However, he added that the Indian alcohol sector has to further develop and this would help in doing so.

He said the FTA would open the flood gates to Europe seeking reduction in tariff on wines, maybe up to 50%.

Sanjiv Puri, Regional Director (India), Angus Dundee Distilleries

The proposed Free Trade Agreement (FTA) between India and the United Kingdom marks a significant milestone in strengthening bilateral trade and investment ties. For Angus Dundee Distillers, this development presents a promising opportunity to enhance our presence in one of the world’s fastest-growing spirits markets.

India’s burgeoning middle class, evolving consumer preferences, and growing appreciation for premium Scotch whisky align well with our commitment to delivering high-quality, authentic Scottish products. A well-negotiated FTA could lead to reduced tariffs and streamlined regulatory procedures, addressing long-standing market access barriers that have limited the full potential of Scotch exports to India.

Currently, imported Scotch whisky faces a high customs duty of 150% in India, which restricts competitiveness and volume growth. A phased reduction in tariffs under the FTA would not only make premium Scotch more accessible to Indian consumers but also support local economic activity through increased trade, investment in distribution, and brand development.

For Angus Dundee, a family-owned independent company with a long-standing tradition of quality and integrity, this FTA offers a platform to expand responsibly, collaborate with Indian partners, and contribute meaningfully to the India-UK trade corridor.

We look forward to the successful conclusion of the agreement and are optimistic about its potential to unlock mutual growth and value for both countries.

ISWAI believes premiumisation will get further boost

The CEO of International Spirits and Wines Association (ISWAI), Sanjit Padhi said, “We anticipate that this will accelerate the ongoing trend of premiumisation within the alcobev sector, positively impacting the exchequer revenues of Indian states. Cheaper prices may also result in premiumisation. India’s increasingly aspirational and discerning consumers will now have access to premium international brands at more accessible prices.”

Pegs on enhanced consumer experience

The Adviser (Tax and Regulatory Affairs) of ISWAI, I.P. Suresh Menon said, “ISWAI and its members welcome the UK-India Free Trade Agreement as a landmark development for the Alcobev sector. The reduction in tariffs offers significant strategic benefits for both countries. India’s increasingly aspirational and discerning consumers will now have access to premium international brands at more accessible prices. This enhanced choice will elevate the consumer experience and boost growth across related sectors such as tourism and hospitality.

“We anticipate that this will accelerate the ongoing trend of premiumisation within the Alcobev sector, positively impacting the exchequer revenues of Indian states. We see this agreement as a win-win for all stakeholders in the spirits sector whilst fuelling trade, attracting investment, and fostering the exchange of best practices. It reflects the shared commitment of India and the UK to deepening economic ties and advancing fair, balanced trade.”

RV Subramanian, Director, Ian Macleod Distillers India Pvt Ltd

The UK India FTA is a long-awaited trade deal covering wide range of goods and services between two countries. The most important one among the items is Scotch whisky, the proposed duty reduction of 75% from present level of 150% is a welcome move and this will benefit all stakeholders – the Governments (Centre and States), Scotch whisky companies and Consumers.

India being a predominantly whisky market, the customs duty reduction would expand the market for Scotch whisky, which is currently less than 2% of total Indian whisky market.

It is to be seen whether the states are increasing excise duty and other levies on imported bottled spirits.

It is difficult to predict now, whether consumer will get the benefit of customs duty reduction from 150% to 75% on Scotch whisky, much will depend on the State Excise and Brand owning companies.”

Scotch Whisky Association calls its ‘once in a generation deal’

While the Indian alcobev sector is still hoping for a ‘level playing field’, the distilleries in Scotland are more than happy.

The Chief Executive of the Scotch Whisky Association, Mark Kent calling it a “transformational” deal said, “The UK-India free trade agreement is a once in a generation deal and a landmark moment for Scotch Whisky to the world’s largest whisky market.

“The reduction of the current 150% tariff on Scotch Whisky will be transformational for the industry. The deal has the potential to increase Scotch Whisky exports to India by £1bn over the next five years and create 1200 jobs across the UK. The deal is good for India too, boosting federal and state revenue by over £3bn annually, and giving discerning consumers in a highly educated whisky market far greater choice from SME Scotch Whisky producers who will now have the opportunity to enter the market.

“This agreement shows that the UK government is making significant progress towards achieving its growth mission, and the negotiating teams on both sides deserve huge credit for their dedication. The Scotch Whisky industry looks forward to working with the UK and Indian governments in the months ahead to implement the deal which would be a big boost to two major global economies during turbulent times.”

Chivas Brothers CEO terms it ‘game-changer’

Jean-Etienne Gourgues, Chivas Brothers Chairman and CEO, said the FTA is a “welcome boost for Chivas Brothers during an uncertain global economic environment.”

He said “India is the world’s biggest whisky market by volume and greater access will be a game changer for the export of our Scotch whisky brands, such as Chivas Regal and Ballantine’s. The deal will support long term investment and jobs in our distilleries and bottling plants in Scotland, as well as help deliver growth in both Scotland and India over the next decade. Slàinte (meaning cheers in Irish) to the UK Ministers and officials who steered the deal though long negotiations.”

Chivas Brothers Ltd. which is part of the Pernod Ricard group of companies, exports over £2bn of Scotch whisky and gin every year, including brands like Chivas Regal, Ballantine’s, The Glenlivet and Beefeater. India is amongst Chivas Brothers’ largest export markets and the biggest consumer of whisky worldwide by volume. The UK-India trade agreement will help solidify and potentially expand on Pernod Ricard’s existing investments, which includes a €200m distillery construction in the Indian state of Maharashtra and £100m in bottling facilities in Dumbarton, Scotland.

Quality and choice will increase across India: Debra Crew

Diageo Chief Executive Debra Crew said, “The UK-India Free Trade Agreement is a huge achievement by Prime Ministers Modi and Starmer and Ministers Goyal and Reynolds, and all of us at Diageo toast their success. It will be transformational for Scotch and Scotland, while powering jobs and investment in both India and the UK.

“The deal will also increase quality and choice for discerning consumers across India, the world’s largest and most exciting whisky market. Diageo is a global leader in beverage alcohol with a collection of brands across spirits and beer categories sold in more than 180 countries around the world. These brands include Johnnie Walker, Crown Royal, J&B and Buchanan’s whiskies, Smirnoff, Cîroc and Ketel One vodkas, Captain Morgan, Baileys, Don Julio, Tanqueray and Guinness.”

The Managing Director and CEO of Diageo India (USL), Praveen Someshwar

While congratulating the leaders for the historic agreement said, “The landmark treaty will enable improved accessibility and choice of scotch for the Indian consumers, the largest and the most exciting whisky market.”

Diageo is a leading player in India’s beverage alcohol sector and is among the top 10 fast-moving consumer goods companies in India by market capitalisation. Diageo has 35 manufacturing facilities across India, employs over 3,300 people directly in market with a further 100,000 jobs supported throughout its value chain. India is one of Diageo’s largest markets globally and accounts for almost half of its total global spirits volume.

Better access to global premium spirits: Sachin Mehta, William Grant & Sons

Sachin Mehta, Managing Director – India of William Grant & Sons India Pvt. Ltd. Said, “This will enable much better access to global premium spirits to India’s growing discerning consumers. This enhanced choice will allow acceleration of the ongoing trend of premiumisation within high-end spirits, not only elevating the Indian consumers experience, but also benefitting the overall industry, trade, exchequer, and related sectors or travel, tourism, and hospitality. We are committed to provide access and choice of world-class brands of our global portfolio to the Indian consumers.”

‘Over the Moon’: Karan Billimoria

Karan Billimoria, Chair of the International Chamber of Commerce, UK, Founder of Cobra Beer and Member, House of Lords, UK Parliament said he was ‘over the moon about the UK-India Free Trade Agreement’.

Calling from the UK, he said, “Negotiations started when I was President of the Confederation of British Industry (CBI) in early 2022 and they have concluded over three years later, whilst I am Chair of the International Chamber of Commerce (ICC) UK.

“India is the fastest growing major economy in the world and this year will become the fourth largest economy globally. In spite of this, India is only the 11th largest trading partner of the UK; it should be one of the handful of largest trading partners.

“I believe this FTA will be a catalyst for bilateral trade, business and investment between the UK and India and will turbocharge bilateral trade in goods and services from the current level of £42 billion to more than double at over £80 billion within the next five years.

“India has historically been a high tariff country, with the extreme being the tariff imposed on Scotch whisky at 150%. Thanks to this FTA, this will halve to 75% and decrease to 40% over the next decade. Scotch whisky exports are, as a result, expected to increase by £1 billion.

“I am hoping that this FTA combined with an investment agreement will also help to increase bilateral investment between the two countries. We already have the examples of Tata investing in Jaguar Land Rover and Tata Steel in the UK, and JCB investing hugely in India over the past decades. Similarly, I am confident that there will be large investments by British alcobev companies in India over the coming years.”