After two years of Covid, Indspirit 2021 Awards evaluation got underway with all seriousness.

It was indeed nice to see the coming together of professionals, after a two year lull, for the Ambrosia wine and spirits tasting sessions, as part of the Indspirit 2021 awards which is happening on December 17 in New Delhi. Five judges for the Ambrosia Alcobev products tasting and four judges for the packaging awards huddled together for two days to judge 252 brands. The eminent jury tasted different brands in all categories of whisky, vodka, gin, rum, brandy, craft spirits, wine and beer and the jury on packaging evaluated on various parameters.

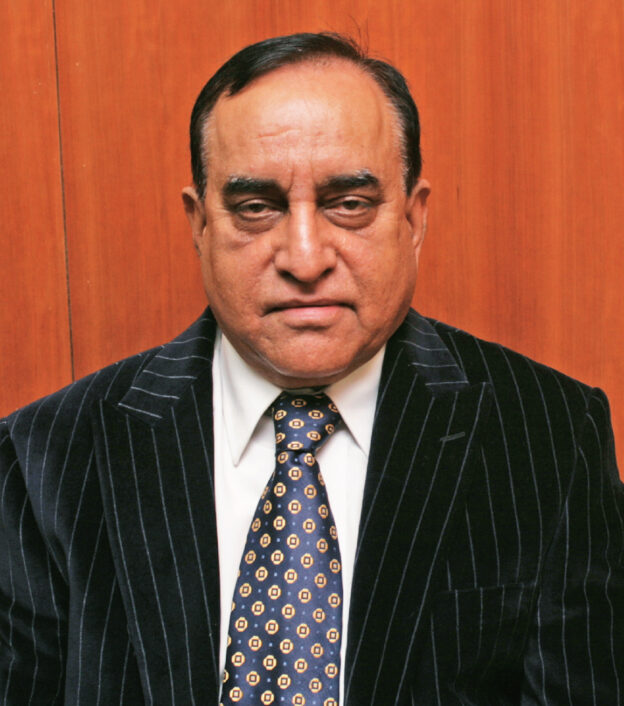

Eminent jury panel

The eminent tasting jury comprised Dr. Binod.K.Maitin, ex-USL and an independent consultant; Graeme Bowie, President – Malt Plant, Piccadily Agro Industries Ltd; Ajoy Shaw, Wine Maker and consultant; Sheetal Kadam, Wine & Spirits promoter and independent consultant; and Bernard Schaefer, a veteran judge from Germany.

The expert packaging jury consisted of Pranav Bhide, Leo Burnett Creative Director; Prof. K. Munshi, former Head of IIT Design department and independent consultant; Dr.Santosh Kshirsagar, Dean of J.J.School of Applied Arts; and Shekhar Ambedkar, Assistant Director and Head of the International Packaging Centre.

Scope for new entrants

The alcobev industry in the country largely comprises of Indian made whisky which accounts for a sizable share in boosting the growth of this sector. Across segments, domestically produced brands account for a higher share of consumer preference and there is still significant scope for new entrants to gain consumer preference.

The spirits industry in India with over 60% preference for whisky, offers great untapped potential for growth. There are several opportunities within the domestic sector markets for Indian whiskies to grow. There is huge country liquor consuming audience base that is seeking better quality products and have been upgrading over the years. India’s relatively young population sees newer individuals/consumers added each year to the legal drinking age – wherein Indian whisky could become the entry point for this audience. There has also been a growth of women whisky drinkers aided by on-premises and retail environments. All of these factors indicate the scope to fully explore the Indian spirits market.

Internationally, markets with a large Indian diaspora as well as those having similar palette to the Indian consumer see a strong preference for Indian whiskies. Some of the world’s top-selling whisky brands come from India and find much consumer love, globally as well.

What the judges have to say about the range

Dr. Binod Maitin says Indian whiskies are predominant among the top whisky rankings based on volume of sales. Indian whiskies have a distinct identity due to the tradition of blending with neutral alcohol produced from cane molasses to produce extra neutral alcohol (ENA). Economy whiskies are made with ENA and flavourings, premium blended whiskies contain Indian and Scotch malts, and single-malt whiskies use only Indian malts. Neutral alcohol from grain has also been adopted by manufacturers, particularly for premium whiskies.

Graeme Bowie, opines that there is huge improvement in quality of the products, even in the economy category. “There is passion for quality.”

Ajoy Shaw is impressed with the huge variety of spirits available for the Indian consumer. The discerning consumer looks for good value, good quality and a plethora of options. Similarly, Sheetal Kadam is delighted to see the expanding range of spirits in the Indian market. The portfolio is ever expanding and good for the consumer who is now spoilt for choice.

Bernard Schaefer, a veteran judge, is always in awe of the brands presented at Indspirit competition, however, some don’t exactly make the mark according to him. One good thing, he says is that there is constant improvement in the quality of products presented every year.

Sensory evaluation

Talking about the competition, Binod Maitin says, “Sensory evaluation is used as the primary means of flavour control in the industry. This chapter describes the origins of flavour in whisky and the typical sensory methods used both during production and in consumer research. The panel is experienced and harmonised. Mistakes in samples are pointed out. Samples are provided for references.”

Graeme Bowie says the brands are fairly good, endorsing the same is Ajoy Shaw who feels that all brands can easily get a bronze medal and more. Sheetal Kadam believes that the quality is above average.

Technology driving change

Technology is driving change in operations and strategy – right from crop analysis to smartphones scanning product labels. Big data and analytics have also been major drivers for the alcobev industry when it comes to improving insights across the supply chain. Having in-place solutions to provide real-time insights can help identify the largest problems at hand and find ways to optimise production and maintain quality.

Analytics is beneficial

Additionally, when we look at operations and quality assessment, and analytics strategy can go a long way in helping run plants, raw material test analysis, blend inspection analysis, quality control, compliance, end of line quality analysis, hygiene assessment, and managing customer complaints. There are multiple visual and physical checks required across various stages, and because it is a restricted environment wherein companies are bound by various regulations, analytics can be extremely beneficial.

Quality of brands improving every year

Talking about the quality of brands on offer, Binod Maitin, who has created many succesful blends, says the alcobev brands are okay. Wines are a problem, he says because of storage issues. Graeme Hamilton opines the products are plausible. Ajoy Shaw believes all brands can do well in the market place. Sheetal Kadam says there is improvement to a large extent as there is demand for upgradation.

Packaging market to touch nearly $39 billion by 2026

The alcoholic drinks packaging market was valued at USD 29.84 billion in 2020, and it is expected to reach a market value of USD 38.87 billion by 2026, registering a CAGR of 5.06% during the forecast period (2021-2026). Globally, growth in disposable income, coupled with increased spending on recreational activities, is a major influencing factor that collectively lead to growth of alcohol consumption, which fuels the growth of the alcoholic drinks packaging market over the forecast period.

Major manufacturing companies in the alcohol industry follow attractive packaging formats, which include ceramic glass bottles, whiskey pouches, bag-in-box, bag-in-tube, etc. Changing consumer preferences are also affecting the market significantly. Over the years, growing awareness among the brand manufacturers about differentiating their alcoholic products based on the packaging is also expected to contribute to the growth of the alcoholic drinks packaging market.

Conventionally, European and American manufacturers are often referred to as the leading producers of alcohol beverages. However, with the rise in demand for Chinese beer and Japanese whiskey, Asia-Pacific is increasingly becoming a major market for alcoholic beverage production, creating a massive demand for alcoholic drinks packaging solutions.

Metal packaging growing market

Owing to various benefits offered by metal packaging, such as better hermetic sealing and high mechanical strength, there is a growing preference for metal packaging from the companies present in the alcoholic drinks packaging market.However, fluctuating raw material prices and implementation of stringent regulations on packaging materials used for alcoholic beverages may hinder the growth of the market.

Judging parameters

The judges looked at parameters such as unit pack, canister, graphics, new ideas and feel. This is what judges had to say on the brands that were presented for packaging, their sustainability and their comparison in the international market place.

Pranav Bhide said the first impressions of the packaging is its versatility. It is important for the brands to stand out. The buzz word in today’s world is sustainability. There is a sea change in the packaging of Indian liquor and it is towards Indianness. Indian brands can match international brands, but it is still not there.

Prof. K. Munshi says after two years of pandemic it is a nice feeling to be here for Indspirit and once again judging packaging. He felt that despite the pandemic entries this year are more and also there is qualitative improvement in packaging. “It was a tough time judging” and hoped that there would be more creativity. However, he felt there was no evidence of sustainable packaging. “Indian liquor industry needs to take help and take advice. Indian brand packaging has long way to go. We need to put in efforts in R & D and innovation.”.

Dr. Santosh Kshirsagar was of the view that this year’s packaging industry did not have much variety as compared to last year. “Indian liquor industry should have a different approach. Indianness needs to be reflected and must stand out in the market place. Sustainability is an extremely important world issue. We have not identified a value for it. It is not easy, but it is a fundamental issue. Caps of bottles are a sensitive issue.. There is a long tradition in design. India has traditional visual imagery. Futuristically it is possible to succeed with this imagery. We need to make a mark with packaging.”

Shekhar Ambedkar says he has seen at Indspirit a range of unique packaging and innovation. “There is uniqueness in materials and the future should be sustainable packaging and believes that regulation would help in that direction. This year there are very commendable glass bottles for beer, especially those with a special tint. Good design is also present. We have been matching international standards. Companies should work towards being unique and that will sell.”