India is cruising towards becoming a $5 trillion economy. Indian alcobev industry stalwarts add credence to FICCI’s take on the budget.

Commenting on the Union Budget 2019-20 recently presented by the Finance Minister Ms Nirmala Sitharaman, Mr Sandip Somany, President, FICCI said, “Directionally the budget is good, and it takes forward the plan that was laid out by the government during the Interim budget. There are several positives in the budget, and it provides a set of benefits for most segments of the society. We see a clear action plan for realising the vision of making India a US$ 5 trillion economy over the next few years with a focus on ease of living.”

Anand Kripalu

“A balanced budget that draws from a long-term vision for the country! Through policy reforms to rejuvenate investment, ‘Make in India’ and Ease of Doing Business, as well as measures to tackle the country’s water shortage and climate change, the budget lives up to the government’s vison of a New India that aims at inclusive growth. The acknowledgement of India Inc’s role as the nation’s job and wealth creators is heartening. Operating with the high standards of compliance, in a sector that is in urgent need of regulatory reform, we are delighted at the Government’s vision of ‘Minimum Government Maximum Governance’, which we hope the Centre will encourage States to adopt towards the alcoholic beverages sector,” points out Anand Kripalu, Managing Director and CEO, Diageo India.

The budget maintained its focus on infrastructure development. While the government would continue with its existing major national programmes like Bharatmala, Sagarmala, Rural roads, Udan and Inland waterways scheme, the vision of taking connectivity to the next level through ‘One Nation One Grid’ for electricity and a similar plan for gas grids, water grids, i-ways and regional airports is indeed ambitious and would be transformational in its impact. “FICCI has been advocating the need for such networks and would work with the government on realising this vision. We are also encouraged by the Minister’s focus on promoting public-private partnership for modernisation and upgradation of the nation’s railway infrastructure,” added Mr Somany.

The MSME sector also got its due focus in the budget. Availability of finance and delay in payments are the two key issues faced by MSMEs. The government has attempted to address these through allocation of `350 crore for interest subvention scheme for GST registered MSMEs and creation of a payments platform to enable filing of bills and payment thereof on the platform itself. Also noteworthy is the suggestion to set up a social stock exchange for listing of social enterprises and voluntary organisations. This is expected to open up new avenues for funding for entities working in the social sectors.

Neeraj Kumar

With the Indian economy poised to become a $3 trillion economy in 2019, the Union Budget balanced prudently between focus on enablers for near term growth with a visionary 10 year road map to sustain and scale this growth.

Closer to our category, the announcement to develop 17 iconic world-class tourist sites is good news. We continue to expect greater transparency and ease of doing business in states and central regulatory framework to enable sustainable and compliant growth for our sector, says Neeraj Kumar, MD Beam Global Spirits & Wine India.

Abhishek Khaitan

The industry sees a confident and clear articulation to boost growth by reduction in corporate tax and sops to housing sector and startups. The focus on sustainability with electric vehicles and water is visionary but enabling infrastructure needs to be implemented.

“The budget is focussed on vision and inclusive growth,” believes Mr Abhishek Khaitan, Managing Director, Radico Khaitan Limited. The new government till date has pursued pro-growth initiatives and, I believe, this budget will continue the impetus to further boost economic growth and investor confidence. The government is well positioned for a swift and efficient execution of progressive initiatives. Smt Nirmala Sitharaman’s maiden Budget – the first to be presented by a female Finance Minister — emphasises on infrastructure development, freeing up liquidity to troubled NBFCs, generating jobs in the MSME sector, and generally enhancing the ease of doing business.

As a listed corporate, we believe that having a 35% public float is positive in terms of better corporate governance standards and valuations and carries a potential of increasing India’s weight in the global indices.

The budget is equally focused on welfare, health, sanitation, water, transformation, standard of living and support to farmers.

Nirmala Sitharaman ji stressing on the ‘Gaon, Garib and Kisan’ aims at enabling the rural economy through multiple schemes. With the aim of boosting the agricultural sector in the country, the government’s plan to reassess the implementation of zero budget farming has the potential of nearly doubling farmers’ income. Additionally, 10 thousand new farmer producer organisations will be set up for ensuring market reach for the farmers. The other schemes announced in the budget such as Pradhan Mantri Matsya Sampada Yojana, cluster-based rural industrialisation for promoting 50,000 artisans, 75000 skilled agri entrepreneurs and overall focus on dairy sector are all very laudable.

The vision of each house having water, electricity and cooking gas by 2022 is commendable and there is a very close interdependence between water, sanitation, health, nutrition, and human well-being. We view water as a central resource for a sustainable India and the thrust to provide piped water to all rural households by 2024 is what inclusive growth is all about.

To conclude I commend Ms Sitharaman for appreciating the contribution of India’s private sector in the fantastic rise of the country’s economy. While the fiscal balance has been managed well with the deficit aimed at just over 3%, the overall, the budget is pro-poor, pro-rural and pro-ease of doing business. The simplification of the GST, the simplification of tax reforms and indirect taxes and the support to startups not only will help in bringing in more capital and employment, it will significantly benefit society at large and help achieve aspirations of millions of Indians.

“I would emphasise that the government has taken due cognisance of the funding needs of a growing economy and this is reflected in a series of measures announced to deepen the country’s capital markets as well as help increase inflows both through the institutional investment and direct investment route. In our pre-budget consultation, FICCI had suggested the need to look at FDI norms in sectors such as insurance, animation, gaming etc. and we are glad this found a mention in the budget,” said Mr Somany. Additionally, to attract cross border investments, the statutory limit of FPI in a company is proposed to be increased from the current 24% to the sector foreign investment limit.

The announcement to further provide `70,000 crore for capital infusion into public sector banks along with measures to strengthen the governance processes within the banks should help in improving the credit flow to the industry. “The NBFC sector has been in focus on account of the stress being faced due to liquidity crunch in the last few months. Acknowledging the important role played by NBFCs, some key measures have been taken which should help ease the liquidity situation for the fundamentally sound NBFCs going ahead. As this happens, we hope to see greater amounts being sanctioned and disbursed by the para-banks particularly in the MSME and retail segment,” said Mr Somany.

Another novel feature of the budget is to marry the benefits of rural infrastructure development with sustainable livelihood opportunities. Having achieved tremendous success over the last five years in terms of promoting connectivity, housing, provision of electricity and clean energy in rural areas, the focus now is to promote traditional resource-based industries and create avenues for self-employment and entrepreneurship.

“From the point of view of the farm community, the decisions to set up 10,000 farmer producer organisations and fully leverage the benefits of e-NAM for getting fair and remunerative price are welcome. In FICCI’s Agenda for the New Government, both these points were highlighted, and we had urged the government that these are essential components of any strategy aimed towards doubling income of our farmers over the next few years,” said Mr Somany.

To strengthen the education system in the country, FICCI had suggested that the government finalises and implements the National Education Policy, sets up a National Science, Technology and Human Research Foundation; and hasten the setting up of Higher Education Commission of India. FICCI would like to thank the government for having incorporated these suggestions in the budget proposals.

On the disinvestment front, FICCI welcomes the government’s decision to enhance the target for the current year to `1.05 lakh crore. We had of course suggested that given the demands on exchequer, government should look at a target of `1.5 lakh crore. Additionally, the government’s decision to consider divesting its stake in select public sector units to below 51% is interesting and we look forward to details on this subject.

“On the taxation front, while we are happy to note the decision to raise the turnover limit from `250 crore to `400 crore for companies that would attract a corporate tax rate of 25%, we had hoped that this rate will be applicable to all firms. Given the way tax policies are evolving globally, we need to be competitive if we are to attract and retain investments at a high level. With the Economic Survey also highlighting the critical role played by private investments in addressing concerns related to growth and employment, a bigger boost to the corporate sector was expected,” said Mr Somany.

Enhanced deduction for interest payments on loan taken for affordable housing, clarification on Angel Tax and the thrust on speedier resolution of legacy tax disputes in the indirect tax segment are some of the other important announcements on the tax side.

Finally, government has remained focussed on making India a ‘cash-lite economy’ and once again we saw in this budget a couple of suggestions that would help the country move ahead on

this track.

Sales of spirits through e-commerce may not be as pronounced as wine, but IWSR research shows that around US$6.5b of spirits were sold online in 2018, a figure that represents 2% of all global spirits’ value sales. For example, ecommerce is reported to now be Pernod Ricard’s fastest growing channel.

Sales of spirits through e-commerce may not be as pronounced as wine, but IWSR research shows that around US$6.5b of spirits were sold online in 2018, a figure that represents 2% of all global spirits’ value sales. For example, ecommerce is reported to now be Pernod Ricard’s fastest growing channel.

“Many of us have been working together for nearly two decades, hence setting up a formal trade association to act as a united global voice on the integrity and social responsibility of our spirits industry is a natural and important step forward. Distilled spirits are a vibrant and highly dynamic sector with a unique diversity of products and producers across the world,” said Marie Audren who will act as Secretary General for the WSA.

“Many of us have been working together for nearly two decades, hence setting up a formal trade association to act as a united global voice on the integrity and social responsibility of our spirits industry is a natural and important step forward. Distilled spirits are a vibrant and highly dynamic sector with a unique diversity of products and producers across the world,” said Marie Audren who will act as Secretary General for the WSA.

“The aims of the WSA are to create a common platform for exchange and have a representative body that will allow us to comment on issues of global relevance, particularly in the areas of trade and regulatory policy, and help develop a positive environment for the sustainable success of the sector,” said Rodolfo González González (Camara Nacional de la Industria Tequilera) who was elected as first President of the WSA.

“The aims of the WSA are to create a common platform for exchange and have a representative body that will allow us to comment on issues of global relevance, particularly in the areas of trade and regulatory policy, and help develop a positive environment for the sustainable success of the sector,” said Rodolfo González González (Camara Nacional de la Industria Tequilera) who was elected as first President of the WSA.

“Distilled spirits are celebrated and responsibly enjoyed around the globe and generate jobs, economic growth and tax revenue in the countries where they are produced. At the same time, in many markets around the world, distilled spirits are heavily taxed and regulated, and we face trade barriers that are only applicable, or applied more excessively, to distilled spirits. This situation needs to be reviewed and addressed,” said Amrit Kiran Singh (International Spirits & Wines Association of India) who was elected Vice President.

“Distilled spirits are celebrated and responsibly enjoyed around the globe and generate jobs, economic growth and tax revenue in the countries where they are produced. At the same time, in many markets around the world, distilled spirits are heavily taxed and regulated, and we face trade barriers that are only applicable, or applied more excessively, to distilled spirits. This situation needs to be reviewed and addressed,” said Amrit Kiran Singh (International Spirits & Wines Association of India) who was elected Vice President.

The vision of each house having water, electricity and cooking gas by 2022 is commendable and there is a very close interdependence between water, sanitation, health, nutrition, and human well-being. We view water as a central resource for a sustainable India and the thrust to provide piped water to all rural households by 2024 is what inclusive growth is all about.

The vision of each house having water, electricity and cooking gas by 2022 is commendable and there is a very close interdependence between water, sanitation, health, nutrition, and human well-being. We view water as a central resource for a sustainable India and the thrust to provide piped water to all rural households by 2024 is what inclusive growth is all about.

d Japan, the category’s two largest markets. In Japan, most RTDs are locally made and almost exclusive to Japan. Their popularity is partly due to the fact that they are relatively dry, which makes them more food-friendly and sessionable. In the US, the popularity of alcohol seltzers has been a tremendous engine for growth in the RTD market. In the cider category, as investment levels in those products continue to rise, almost 270m cases are expected by 2023, a 2.0% CAGR 2018-2023. Both of those categories (mixed drinks and cider) are taking share from beer as perceived accessibility increases (less bitter, easier to drink).

d Japan, the category’s two largest markets. In Japan, most RTDs are locally made and almost exclusive to Japan. Their popularity is partly due to the fact that they are relatively dry, which makes them more food-friendly and sessionable. In the US, the popularity of alcohol seltzers has been a tremendous engine for growth in the RTD market. In the cider category, as investment levels in those products continue to rise, almost 270m cases are expected by 2023, a 2.0% CAGR 2018-2023. Both of those categories (mixed drinks and cider) are taking share from beer as perceived accessibility increases (less bitter, easier to drink).

The margins created by retailing your beer instead of selling it wholesale have sustained the growth of microbreweries. This successful approach has succeeded in generating phenomenal growth in the industry.

The margins created by retailing your beer instead of selling it wholesale have sustained the growth of microbreweries. This successful approach has succeeded in generating phenomenal growth in the industry.

Many of your clients will also want to enjoy their favourite beer at home or on a picnic. And you need to serve them, or they will buy their tipple from the competition. Therefore you need to satisfy this type of consumption by offering bottled beer, pretty soon after starting your brewery. Initially the quantities to be bottled are relatively modest – maybe only 500 or 1000 bottles at a time for each of your various recipes. Initially, therefore, the easy way, although an expensive way, is to contract bottle outside the premises. This seems the way to go. Contract bottling has many disadvantages and could eat into your margins because of extra logistics cost and scheduling. In-house bottling could be the solution. Bottling in-house requires generally more money than anticipated.

Many of your clients will also want to enjoy their favourite beer at home or on a picnic. And you need to serve them, or they will buy their tipple from the competition. Therefore you need to satisfy this type of consumption by offering bottled beer, pretty soon after starting your brewery. Initially the quantities to be bottled are relatively modest – maybe only 500 or 1000 bottles at a time for each of your various recipes. Initially, therefore, the easy way, although an expensive way, is to contract bottle outside the premises. This seems the way to go. Contract bottling has many disadvantages and could eat into your margins because of extra logistics cost and scheduling. In-house bottling could be the solution. Bottling in-house requires generally more money than anticipated.

The metal touching your lips is still a factor in terms of flavour, but most craft brewers suggest pouring out beer into a glass before sipping, whatever package it comes in. It may be coolness, or it may be convenience, but the bottom line is, cans are getting cheaper. Bottling in-house remains a simpler, cheaper process. The Brewers Association estimates just 3% of craft beer on the shelves is in a can. Sixty percent still goes out in bottles, and the rest is sold in kegs. Glass has been a very reliable package and tradition will prove itself well that glass is not going anywhere.

The metal touching your lips is still a factor in terms of flavour, but most craft brewers suggest pouring out beer into a glass before sipping, whatever package it comes in. It may be coolness, or it may be convenience, but the bottom line is, cans are getting cheaper. Bottling in-house remains a simpler, cheaper process. The Brewers Association estimates just 3% of craft beer on the shelves is in a can. Sixty percent still goes out in bottles, and the rest is sold in kegs. Glass has been a very reliable package and tradition will prove itself well that glass is not going anywhere.

India’s craft beer industry accounts for 2-3% of the country’s beer market which is largely skewed towards the stronger version. The surge of interest in craft beer has been driven by millennials, many particularly interested in this form of beer that is more authentic, premium and has a complex flavour compared to regular lager sold by MNCs.

India’s craft beer industry accounts for 2-3% of the country’s beer market which is largely skewed towards the stronger version. The surge of interest in craft beer has been driven by millennials, many particularly interested in this form of beer that is more authentic, premium and has a complex flavour compared to regular lager sold by MNCs.

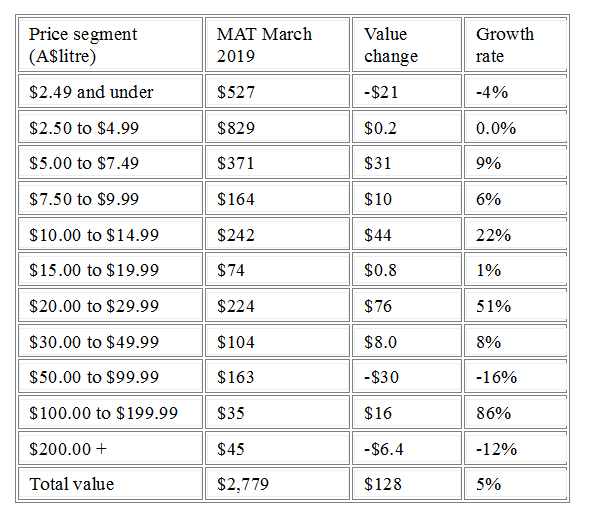

“What we are seeing is a drop in volumes in the lower value categories and this places Australia well as the global consumer premiumises and drinks less but more expensive wines,” Mr Clark said.

In the China market we have grown our value again and we are outperforming competitors, with the Global Trade Atlas figures showing that in the year ended February 2019, Australia had a 29% share of the imported wine market – up from 26% a year ago

“What we are seeing is a drop in volumes in the lower value categories and this places Australia well as the global consumer premiumises and drinks less but more expensive wines,” Mr Clark said.

In the China market we have grown our value again and we are outperforming competitors, with the Global Trade Atlas figures showing that in the year ended February 2019, Australia had a 29% share of the imported wine market – up from 26% a year ago

In the 12 months to March 2019, the value of wine exported in glass bottles increased 3% to $2.22 billion and decreased in volume 5% to 355 million litres (39 million 9-litre case equivalents). The combination of the increased value and lower volume means that the average value of bottled wine increased 9% to $6.24 per litre FOB, a near-record.

In the 12 months to March 2019, the value of wine exported in glass bottles increased 3% to $2.22 billion and decreased in volume 5% to 355 million litres (39 million 9-litre case equivalents). The combination of the increased value and lower volume means that the average value of bottled wine increased 9% to $6.24 per litre FOB, a near-record.

The regions in growth are:

• Northeast Asia, up 8% to $1.2 billion,

• Europe, up 3% to $612 million,

• Southeast Asia, up 7% to $170 million,

• Oceania, up 15% to $107 million, and the Middle East, up 16% to $32 million.

The regions in growth are:

• Northeast Asia, up 8% to $1.2 billion,

• Europe, up 3% to $612 million,

• Southeast Asia, up 7% to $170 million,

• Oceania, up 15% to $107 million, and the Middle East, up 16% to $32 million.

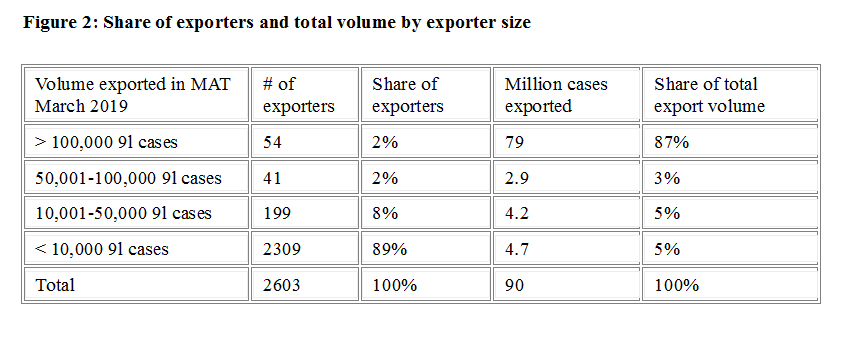

There were 2603 active exporters in the period, a 16% increase from the previous year. During the year, 1786 companies either started exporting or increased the value of their exports, contributing $374 million to the growth in overall value. This growth was partially offset by 1328 exporters whose export value decreased or they ceased shipment altogether; their exports declined by $246 million.

There were 2603 active exporters in the period, a 16% increase from the previous year. During the year, 1786 companies either started exporting or increased the value of their exports, contributing $374 million to the growth in overall value. This growth was partially offset by 1328 exporters whose export value decreased or they ceased shipment altogether; their exports declined by $246 million.

sign that the Scotch Whisky industry remains confident about the future. This is great news for our many employees, our investors, supply chain and, of course, for our consumers all over the world, who love Scotch.

“This report also highlights the high rate of domestic tax that Scotch Whisky faces in the UK. In the US, Scotch and other whiskies are taxed at just 27% of the rate that HM Treasury taxes us here at home. We will continue to press the Chancellor for fairer treatment of Scotch Whisky in our domestic market, which reflects the vital economic contribution the thousands of people who work in whisky make to the UK economy every day.”

sign that the Scotch Whisky industry remains confident about the future. This is great news for our many employees, our investors, supply chain and, of course, for our consumers all over the world, who love Scotch.

“This report also highlights the high rate of domestic tax that Scotch Whisky faces in the UK. In the US, Scotch and other whiskies are taxed at just 27% of the rate that HM Treasury taxes us here at home. We will continue to press the Chancellor for fairer treatment of Scotch Whisky in our domestic market, which reflects the vital economic contribution the thousands of people who work in whisky make to the UK economy every day.”

contributes more than double than life sciences (£1.5bn) to the Scottish economy, supporting more than 42,000 jobs across the UK, including 10,500 people directly in Scotland, and 7,000 in rural communities.

contributes more than double than life sciences (£1.5bn) to the Scottish economy, supporting more than 42,000 jobs across the UK, including 10,500 people directly in Scotland, and 7,000 in rural communities.

A growing spirits distribution sector worldwide – especially in France where there were now between 20 and 30 national distributors compared with three or so 29 years ago – was further evidence of trade and consumer demand.

Trends pushing spirits expansion are: revivals of traditional spirits such as Calvados and Armagnac where there was growing interest in Asia; rediscovery of locally-produced spirits, eg Irish Whisky, Gin and Vodka; global interest in little-known spirits such as Mezcal; new exotic spirits such as agricultural rum from Tahiti, “where no spirits at all were made 10 years ago”.

A growing spirits distribution sector worldwide – especially in France where there were now between 20 and 30 national distributors compared with three or so 29 years ago – was further evidence of trade and consumer demand.

Trends pushing spirits expansion are: revivals of traditional spirits such as Calvados and Armagnac where there was growing interest in Asia; rediscovery of locally-produced spirits, eg Irish Whisky, Gin and Vodka; global interest in little-known spirits such as Mezcal; new exotic spirits such as agricultural rum from Tahiti, “where no spirits at all were made 10 years ago”.

“A stable government is indeed welcome for the nation and economy. We hope that the new government will reinforce its progressive policies towards the industry, and usher in the next phase of reforms to promote ease of doing business and ‘Making in India’. We also look towards the Federal government to encourage states to urgently bring comprehensive regulatory reform into key state- GDP contributing sectors such as alcoholic beverages,” says, Anand Kripalu, Managing Director and CEO, Diageo India.

“A stable government is indeed welcome for the nation and economy. We hope that the new government will reinforce its progressive policies towards the industry, and usher in the next phase of reforms to promote ease of doing business and ‘Making in India’. We also look towards the Federal government to encourage states to urgently bring comprehensive regulatory reform into key state- GDP contributing sectors such as alcoholic beverages,” says, Anand Kripalu, Managing Director and CEO, Diageo India. The beer industry has its fair share of challenges. And with the competition heating up and input prices rising it is becoming difficult to invest in growth. “With a strong mandate that the government has received, we look forward to sustained reforms that will spur further growth in the economy. We also look forward to continued emphasis on ease of doing business,” says Shekhar Ramamurthy, Managing Director, United Breweries Ltd.

The beer industry has its fair share of challenges. And with the competition heating up and input prices rising it is becoming difficult to invest in growth. “With a strong mandate that the government has received, we look forward to sustained reforms that will spur further growth in the economy. We also look forward to continued emphasis on ease of doing business,” says Shekhar Ramamurthy, Managing Director, United Breweries Ltd. “It is indeed a blessing that India has elected a strong and stable Goverment and I look forward to more structural reforms so that India can continue on a strong growth trajectory with gainful employment for all its citizens. I also expect the federal goverment to build consensus amongst all states to include potable alcohol in GST,” said Deepak Roy, ABD Vice Chairman.

“It is indeed a blessing that India has elected a strong and stable Goverment and I look forward to more structural reforms so that India can continue on a strong growth trajectory with gainful employment for all its citizens. I also expect the federal goverment to build consensus amongst all states to include potable alcohol in GST,” said Deepak Roy, ABD Vice Chairman. But now companies are scaling down their volumes where the margins are thinner, introducing premium brands and focussing on profits. Diageo is working to get consumers to ‘premiumise’. The company is working to taking a long term view and creating business value. The history associated with Diageo’s iconic brands, too, bears testimony to such far-sightedness.

But now companies are scaling down their volumes where the margins are thinner, introducing premium brands and focussing on profits. Diageo is working to get consumers to ‘premiumise’. The company is working to taking a long term view and creating business value. The history associated with Diageo’s iconic brands, too, bears testimony to such far-sightedness.

While congratulating on the grand come back of PM Narendra Modi, Dr. Lalit Khaitan, Chairman of Radico Khaitan Ltd. says, “The voters have endorsed Modi’s decisive leadership, his ability to take the country from red tape to red carpet, his government’s multiple schemes to pull out millions from abject poverty and provide them essential services like electricity, cooking gas, bank accounts and free health services.”

While congratulating on the grand come back of PM Narendra Modi, Dr. Lalit Khaitan, Chairman of Radico Khaitan Ltd. says, “The voters have endorsed Modi’s decisive leadership, his ability to take the country from red tape to red carpet, his government’s multiple schemes to pull out millions from abject poverty and provide them essential services like electricity, cooking gas, bank accounts and free health services.” KALS CMD Mr.S Vasudevan says on the historic victory of the NDA government, “I wish our Honourable Prime Minister Mr. Modi for his impeccable victory. This is a well-deserved victory for transforming our nation in terms of controls, governance, and GDP growth. I personally look forward to having reforms in the IMFL Industry as well that contributes significant revenue to the respective states. I wish the new government all the very best and I’m confident under the leadership of our Honourable PM, India will get into the strides of excellence.”

KALS CMD Mr.S Vasudevan says on the historic victory of the NDA government, “I wish our Honourable Prime Minister Mr. Modi for his impeccable victory. This is a well-deserved victory for transforming our nation in terms of controls, governance, and GDP growth. I personally look forward to having reforms in the IMFL Industry as well that contributes significant revenue to the respective states. I wish the new government all the very best and I’m confident under the leadership of our Honourable PM, India will get into the strides of excellence.” And having overcome the legacy issues associated with the USL acquisition, Diageo claims to have set itself the ambitious target of “changing the alcohol industry in India”. Much of that effort revolves around a campaign to inculcate the spirit of ‘responsible drinking’, which translates into reinforcing moderation, and in promoting road safety in collaboration with State governments.

And having overcome the legacy issues associated with the USL acquisition, Diageo claims to have set itself the ambitious target of “changing the alcohol industry in India”. Much of that effort revolves around a campaign to inculcate the spirit of ‘responsible drinking’, which translates into reinforcing moderation, and in promoting road safety in collaboration with State governments.