Author Archives: Bhavya Desai

Ethanol as essential energy

In 2020, the lesson learned was that ethanol is the embodiment of “Essential Energy”. Ethanol produces the renewable fuel and delivers the nutritious feed that livestock and poultry producers rely upon. Ethanol proved essential for weathering the Covid.

Recognising the critical need to combat the spread of the virus, many ethanol producers quickly took the steps necessary to produce the high-purity alcohol that comprises roughly 70% of every bottle of hand sanitizer. Later in the year, news that vaccines were in development was greeted with understandable enthusiasm; it signalled the beginning of the end of the pandemic. But it also created a new challenge.

Much of the vaccine would need to be transported and stored at incredibly low temperatures, necessitating increased supplies of dry ice. Once again, the ethanol industry – which produces supply of CO2, the critical component of dry ice – was called upon to meet the increased demand for an essential product. The 2021 Ethanol Industry Outlook suggest that tomorrow’s challenges of climate change, food and energy security, and rural prosperity will continue to make ethanol an Essential Energy.

The global ethanol market size was valued at USD 89.1 billion in 2019 and is anticipated to register a compound annual growth rate (CAGR) of 4.8% from 2020 to 2027. The demand for the product is driven by growing usage of the product as a biofuel. The rising consumption of alcoholic beverages is another major factor supporting market growth. Ethanol can be manufactured by both natural as well as petrochemical feedstocks. In the natural process, natural sugars are fermented in the presence of yeast.

The Indian ethanol market is projected to grow from $2.50 billion in 2018 to $7.38 billion by 2024, exhibiting a CAGR of 14.50% during 2019-2024, on the back of increasing ethanol use in applications such as fuel additives and beverages. Ethanol is a prominent alcoholic beverage, mainly found in beer, cider, wine, spirits and ale. Indian government is trying to reduce its dependence on imported crude oil and incentivising Indian sugar manufacturers to produce ethanol for Oil Marketing Companies (OMCs). It is expected that ethanol production will increase by three to five folds in the future in order to meet the demand for its 20% Fuel Blending Programme (FBP). Factors such as increasing alcohol consumption and changing lifestyle along with growing influence of the western culture are likely to drive the demand for ethanol in the country.

In terms of source, the Indian ethanol market has been categorised into sugar & molasses based ethanol, second generation (mixed grains) and grain-based ethanol. Based on application, the market has been segmented into industry solvent, fuel & fuel additive, beverages, disinfectant, personal care, and flavouring & fragrance. Based on purity, the market has been segmented into denatured and undenatured. Government’s emphasis on ethanol production from bio mass and solid waste is likely to become a major source of ethanol production in future.

India has target of achieving 10% Ethanol blending by 2022 and 20% Ethanol blending by 2030.

Ethanol remains the highest-octane, lowest-cost motor fuel on the planet. And it is the only tool available at scale in the near term to significantly reduce carbon emissions from gasoline. Meanwhile, the industry’s co-products – including distillers grains and distillers oil – provide indispensable protein and energy to a hungry world.

State-run oil marketers are required to blend 10% ethanol in petrol under the national policy on biofuels 2018 by 2022 and 20% by 2030. But so far this has not been moving at scale as surplus sugarcane was not easily available and the blending is only 5% now.

To improve supplies of ethanol-blended petrol, the government has widened the feedstock options. Accordingly, the National Biofuel Coordination Committee of the oil ministry in June allowed the conversion of surplus rice with the Food Corporation into ethanol.

It has also allowed procurement and conversion of the surplus maze into ethanol. With this, the ethanol production happens from six feedstocks -100% sugarcane juice/sugar syrup/sugar; B-heavy molasses which is sweeter; C-heavy molasses which is mildly sweet; damaged food grain; surplus rice from FCI and surplus maize.

Adding surplus rice procurement process from FCI has already started for the 2020-21 cycle and very soon OMCs shall start procuring maze for making ethanol as well.

Of the total blending by 2022, 300-350 crore litres will come from sugarcane, and the rest from non-sugar feedstock like damaged foodgrains, adding 160 crore litres of 180 crore litres come from sugarcane.

The estimated annual petrol demand is pegged at 4,600 crore litre this year, which means 450-460 crore litre of ethanol mixing in the December 2020-November 2021 crop cycle.

Mills in U.P. are expected to produce about 105lac tons in 2020-21 SS, as against 126.37 lac tons produced in 2019-20 SS. Estimated lower production this year is because of reportedly lower cane yields and lower sugar recoveries in the State, much higher diversion to gur/khandsari units and much higher diversion of sugar for production of ethanol by way of diversion of B-heavy molasses and sugarcane juice. Based on the allocations made by the OMCs for supply of ethanol in 2020-21, it is estimated that about 6.74 lac tons of sugar will be diverted for production of ethanol by the sugar mills in the State in the current year as compared to about 3.70 lac tons diverted in 2019-20 SS.

In the sector of cane development and sugar industry, distillation of 120 kilolitres per day capacity will be established in Pipraich sugar mill which will start in December 2021. There will be facility to manufacture ethanol.

Pipraich sugar mill will be the first sugar mill in North India to manufacture ethanol directly from sugarcane juice.

The crushing capacity of Mohiuddinpur-Meerut sugar mill of the corporation area was increased to 3,500 TCD from 2,500 TCD.

A target to increase the crushing capacity of Mohiuddinpur-Meerut sugar mill from 3,500 TCD to 5,000 TCD is proposed to benefit 1,00,000 cane farmers in the state.

Cabinet has approved guidelines for production of ethanol from cane juice and syrup in the distilleries of the state.

Cabinet order is as follows: The decision will aid in reducing excess sugar stocks, increasing liquidity with the sugar mills for settling cane farmer’s dues and making higher ethanol available for Ethanol Blended Petrol (EBP) Programme; Surplus sugar production has depressed sugar prices, thereby impacting sugar industry’s capacity to pay sugar cane farmers. The ex-distillery price of ethanol derived from cane juice is `85 per liter while that from C- heavy molasses is `45.69 per liter, for the ethanol supply year beginning December 2020. Higher remunerative price for ethanol produced from cane juice will help in reduction of cane farmer’ arrears; Sugarcane juice shall mean, primary juice, secondary juice, mixed juice and clear juice as obtained by sulphitation or defecation process. Sugarcane syrup shall mean concentrated juice having total dissolved solid content not less than 50 brix; Sugar mills with captive distilleries within the premises shall be allowed to produce ethanol from cane juice and syrup. Standalone distilleries will not be allowed to produce ethanol from cane juice and syrup; Ethanol produced from cane juice shall be used only for Ethanol Blended (EBP) Programme; as no sugar or molasses is produced in the process, the income from ethanol derived from cane juice and syrup shall be tagged for payment of sugarcane dues to farmers. All the instructions regarding cane allotment and cane payment issued from time to time shall be binding on these units and The State Government has earlier permitted ethanol production from B-heavy molasses. Since then, more than 40 distilleries in the state are producing ethanol form B-heavy molasses, resulting in a significant increase in ethanol production in the state. The state is the highest producer of ethanol in the country.

Cabinet decision will empower the sugar mills to choose between production of sugar or production of ethanol from cane juice, based on viability of market price of sugar, further improving the income of sugar mills and there by better cane payment to farmers.

Maharashtra is expected to produce about 105.41 lac tons in 2020-21 SS, as against 61.69 lac tons produced in 2019-20 SS. Higher estimated sugar production this year is mainly due to increased cane area by about 48% and better cane yields as compared to the last season owing to favourable weather conditions as well as increase in percentage of plant cane. Based on the allocations made by the OMCs for supply of ethanol in 2020-21, it is estimated that sugar mills in the State will divert about 6.55 lac tons of sugar for production of ethanol in the current year, which is substantially higher as compared to only about 1.42 lac tons diverted in 2019-20 SS.

The third major sugar producing State viz. Karnataka is expected to produce about 42.5 lac tons of sugar in 2020-21 SS, as against 34.94 lac tons produced in 2019-20 SS. Similar to Maharashtra, there is an increase in cane area and reportedly better cane yields and better sugar recoveries, which is resulting in higher estimated sugar production in the current season. Mills in the State are expected to divert about 5.41 lac tons of sugar for ethanol production in the current year as compared to about 2.42 lac tons diverted in 2019-20 SS.

These three major sugar-producing States are estimated to contribute almost 93% of the total estimated diversion of sugar into ethanol of about 20.10 lac tons in the current season.

The Government had announced two important policy decisions to improve liquidity of sugar mills during 2020-21 SS, by way of announcement of sugar export programme of 60 lakh tons and upward revision of ethanol prices for 2020-21 SS, which have been welcomed by the industry.

However, the government is yet to announce implementation of a very crucial policy decision i.e. increasing MSP of sugar. This will improve the liquidity of the mills enabling them to make timely cane payment to farmers also. The ex-mill sugar prices are already under pressure in almost all the States and to ensure that sugar mills are able to pay to farmers on time, there is need to quickly decide on increasing the MSP of sugar.

Opportunities for beer in 2021 & beyond

Beer suffered quite heavily during 2020, primarily due to its reliance on the on-premise. Beer markets in Italy, the UK and Colombia were amongst those particularly hard hit due to lockdown restrictions. Traditional inbound tourism hubs continue to hurt. Some brewers also faced legislative issues, notably full bans on the sale of alcohol in South Africa and India, and a ban on domestic brewing in Mexico. Changes in consumer purchasing behaviour in the off-premise, such as a tendency to purchase multi-packs and less time spent browsing, meant some players had to adapt to new packaging offerings and/or new distribution channels as well. Overall, the industry will likely see an approximate 9% decline in beer consumption across 19 key markets (2019 to 2020). Amidst the challenges, however, there are bright spots:

Market recovery

IWSR research shows that some beer markets will emerge from 2020 relatively unscathed: beer proved remarkably resilient in Japan, for example, especially in the face of a strongly-advancing ready-to-drink (RTD) category. Although beer in China will see an approximately 7% loss in volume in 2020, the decline is not as bad as many feared it could be, primarily as restrictions had largely been lifted by the key summer months. Looking forward, developing markets will continue to provide growth opportunities for brewers. Even before Covid-19, many developed beer markets had stagnated in recent years. Key players have invested heavily in increasing their brewing capability and distribution networks across developing markets. Africa has been a particular focal point for investment, with new breweries opened in countries including Mozambique, Kenya and Ethiopia. In Asia, Heineken and Carlsberg have been very active in Vietnam and Cambodia. In 2019, Heineken enjoyed success with the launch of Heineken Silver in Vietnam, while Carlsberg’s relaunch of Huda was also well received. Of the leading markets, IWSR projects these two countries to be in the top ten growth markets between 2019 and 2024. The potential for beer growth in India is strong as well. AB InBev, for example, began brewing Budweiser in the market back in 2010. In January 2021, Kirin Holdings announced an investment of $30 million in New Delhi-based B9 Beverages, the maker of the Indian craft beer Bira. IWSR anticipates beer consumption in India to return to pre-Covid-19 levels by the end of 2023, continuing on its growth path from there.

Expanding beyond beer

As consumers moved to the at-home occasion, the trend for convenience has helped to shape purchasing behaviours. In markets such as the US, the ready-to-drink (RTD) category, which includes hard seltzers, has been taking share from beer. RTDs provide a growing opportunity for brewers to diversify their product portfolios. Indeed, Heineken entered the hard seltzer category in September 2020, with the launch of Pure Piraña in Mexico and New Zealand. In the US, Heineken partnered with AriZona to launch the AriZona SunRise Hard Seltzer in October 2020. AB InBev states that Bud Light Seltzer is their leading innovation in the US market, with over 75% of volume being incremental to their portfolio. In fact, 2021 was the first year in which a hard seltzer commercial (Bud Light Seltzer) aired during the Super Bowl. Malt-based RTDs are currently dominant in the US owing to their taxation base, and brewers there are in prime position to take advantage. Elsewhere, the alcohol base of choice varies by country, driven by consumer preference and local alcohol tax structures.

Changes in purchasing behaviour propel e-commerce

As with the wider beverage alcohol industry, Covid-19 has propelled the value of the alcohol e-commerce channel. Heineken, for example, reported that Beerwulf, its direct-to-consumer platform in Europe, nearly doubled its revenues in 2020, while in the UK, its revenues tripled. Online sales of its home-draught systems grew as well. Beer has traditionally under-traded online, primarily due to the channel offering lower margins. However, this will change as consumers continue to buy more groceries online and beer is included in the weekly shop. This is especially true in the US, where IWSR expects sales of online beer to grow rapidly as supermarket chains increasingly invest in the channel. Online beer sales hold the greatest market share in countries including Japan, the UK and the US. From a lower base, online beer sales will also grow rapidly over the next five years in markets such as Israel and Nigeria.

The entrepreneurial spirit of small-batch players

Craft breweries, which tend to be more dependent on the on-premise, have propelled interest in the global beer category and revitalised its fortunes in many markets. IWSR believes that the entrepreneurial spirit of the sector will mean that craft brewery regeneration will be quick. In the US, for example, IWSR has seen the pandemic lead to a “buy local” approach amongst some consumers, which will benefit small-batch players.

Innovation in the no/low space reignites the category

No- and low-alcohol beer is a bright spot for the category, as moderation and wellness trends continue to resonate with consumers. IWSR data shows that, to date, most volume has come from no-alcohol rather than low-alcohol beer across 10 key markets. Broadly, low-alcohol beer is giving way to no-alcohol offerings particularly in markets such as Australia, France and the UK. Spain, for example, is seeing a shift from low- to no-alcohol beers, as consumers seek healthier choices and view the newer 0.0% brands as more modern. In South Africa, investment from Heineken and the emergence of a craft segment has helped to generate interest in the no-alcohol category. While no-alcohol beer has existed for decades, in markets like the US, no-alcohol beer has premiumised through the release of no-alcohol versions of non-lager styles, long the domain of no-alcohol beer. More recent no-alcohol styles, such as IPAs, stouts or porters, are starting to make a real impression, driven particularly by new challenger brands, many of which are not linked to traditional brewing. The recent no-alcohol extension of Guinness – despite some teething issues – will help to underline that no-alcohol beers are no longer the sole domain of lagers. While several key beer players continue to steer the no/low beer category, the market is fragmented with a number of smaller brands vying to establish themselves as market leaders in this space. The segment is likely to become even more of a focus for smaller craft producers who are able to bring a diverse range of products to the market in future.

How Asian drinks brands are targeting new markets

Most Asian drinks brands sell the majority of their volumes domestically, where brand awareness is high and drinking cultures are long established. For example, IWSR data shows that approximately 97% of Japanese beer, wines, spirits and RTDs are consumed in the local market. When looking at just the premium-and-above price segment, over 60% of Japanese wines and spirits are consumed locally. But as competition from international brands mounts, local distillers, brewers and winemakers are dedicating more time and resources to developing their presence in overseas markets.

“There are lot of local champions that have a very strong position within their own market but little presence outside,” explains Tommy Keeling, Research Director at IWSR. “As Asian populations grow richer, consumers are trading up to imported drinks brands and the position of local champions suddenly looks less secure, so many are looking to diversify abroad.”

Keeling adds that for many brands, the real benefit of international expansion is the resulting uptick in interest in their domestic markets. In the case of Chinese spirit baijiu, for example, exports are unlikely to ever be more than a fraction of local sales, but distillers are hoping growing interest in the category abroad will boost its popularity at home.

Baijiu is a wealthy category, so brands are able to invest in high profile display advertising, such as Wuliangye’s billboard in Times Square. One of the main aims of this strategy would be to target relatively wealthy Chinese tourists who are already familiar with the brand. Luzhou Laojiao, another large baijiu producer, sponsored the 2019 Australian Open with its high-end Guojiao 1573 brand, again, principally targeting Chinese viewers.

For smaller brands such as Fenjiu, the main goal in international markets is education. “We would like to continue educating the UK market on baijiu and increase both trade and consumer awareness and understanding of this category,” says Qiqi Chen, managing director of Cheng International, the UK distributor of Fenjiu.

The brand takes a more intimate approach to marketing through meetings, masterclasses and tasting sessions, all supported through a strong social media drive. “There are two main baijiu education themes for us,” says Chen. “One is introducing Chinese food and drink culture, and the other is showing how Chinese baijiu can blend well with the western lifestyle.”

In order to offer a “more direct experience” of its brand, Fenjiu will increase its work with bars, restaurants, hotels and retailers, as well as brands outside of the food and drink industry.

Keeling adds that once brands start to expand internationally, it is crucial for them to tailor their approach to the market in which they are selling. For example, in South Korea, soju consumption is widespread, so brands mostly compete on price. However, due to shipping costs, import duties and excise taxes, the product becomes more expensive in overseas markets. As such, brands would be better to promote a different set of values.

For Asian beer brands, giving consumers an authentic taste of their respective cultures is an important way to expand their foreign fan base. The UK in particular gives brands the opportunity to grow their reach through the restaurant channel. Indian beer brand Kingfisher, for instance, has 5,000 distribution points in Indian and Bangladeshi restaurants in the UK.

John Price, head of marketing at KBE Drinks, the UK distributor of Kingfisher, notes that the brand “can be found in every type of eatery”, from high street curry houses to Michelin starred restaurants. “The restaurant channel will always remain the beating heart of our business, but it is sometimes hard to break out of this into wider consumption occasions,” he adds.

This is where sports sponsorships come in. Through commercial partnerships such as these, brands become visible in a new context. Kingfisher is currently a partner of Southampton FC, Leeds United FC, Sussex County Cricket and Wigan Warriors Rugby League Club. “We don’t take on a partnership unless we get pouring rights and this gives consumers the chance to re-evaluate the brand in a fun and exciting environment,” adds Price.

Thailand’s Chang Beer, which is the official beer of Leicester City Football Club, has an international marketing strategy centred around provenance and heritage. “Growing internationally is a journey that is carefully curated with the right partners, the right channels and the right marketing mix,” says Ronnie Teo, head of group marketing at Chang.

“It is important to ensure that we work with partners who share the same long-term convictions as us. Our partners understand what our Chang brand stands for – its provenance and values – and collaborate with us to market the brand in the right sales channels with the right messaging.”

For a number of years, Chang has hosted the Chang Sensory Trails event in London, which celebrates Thai cuisine in a contemporary setting filled with music and street art. Events such as these allow Asian brands to become an essential part of the cultural experiences and representations of their respective nations.

Ultimately, says Teo, to grow internationally, brands must first have a strong domestic business. “To that end, we have seen our marketing efforts in Thailand pay dividends, with our market share growing by more than 15% share points between 2014 and 2019. This strong growth has made Chang an iconic local champion, appealing to Thais, as well as the millions of tourists that visit Thailand annually. With a solid domestic foundation, we were then able to springboard our international marketing efforts.”

Bacardi bullish about 2021 despite challenges of 2020

Its been a challenging year to say the least for the Alcobev Industry. But with the industry now seemingly heading in the right direction Anmol Gill, Head of Customer Marketing, Bacardi India spoke to Vincent Fernandes and Lopamudra Ganguly on the challenges of 2020, the prospects for 2021 and Bacardi’s Green initiative.

How have Bacardi brands performed in the second half of 2020?

With the festive season ushering in post the lockdown, Bacardi brands have been doing well. There’s renewed optimism as the overall industry is recovering and this has helped increase Bacardi brands’ share in the market. The growth for Bacardi brands has been different across different regions on basis of the occasions that they’re consumed and whether they’re in the High Proof or Low Proof categories.

And in this duration, consumers have become more informed on their knowledge of spirits and cocktails owing to their homemade experiments with cocktails. As on-trade opens up, this will lead to an informed appreciation for bartenders’ skills and greater innovations at bars.

What was your Marketing Strategy during the pandemic?

During the pandemic we kept the consumer at the heart of everything we did, we continued to create moments that matter across brands with their respective cultural passion points of dance, music, comedy and more. We had to remain more agile than ever as consumer behaviour was shifting rapidly and has in many ways changed permanently in this duration. Digital became the consumers’ mainstay as they were looking for avenues to create pre-Covid moments and occasions. Now, it is a part and parcel of the consumer experience, so going forward on-ground and digital experiences will coexist across experiences and campaigns.

As a leader of experiences, our main goal lies in co-curating these new occasions and formats, along with our consumers – understanding how we can meet them at their doorsteps instead of the other way around. Virtual mixology masterclasses, are a great example of the manner in which our brands like Dewar’s and Bombay Sapphire enabled to enjoy their favourite cocktails on a special occasion, when they couldn’t step out to the bar.

Virtual concerts, such as the #HappyAtHome concerts hosted by Bacardí, recreating ‘weekend gigs’ that consumers could enjoy along with their friends, is another creative format where we have adapted to serve what the consumer is craving while staying true to our brand purpose.

How was the response to these marketing initiatives?

All of these campaigns successfully brought alive the brands’ ethos and engaged with the consumers in the formats that they were seeking while also transcending geographical boundaries, enabling access to consumers across the nooks and corners of the country.

How do you see Bacardi faring in 2021?

As the world economy will recover gradually from the pandemic, so will the alcobev industry. With online channels opening up and on-trade beginning to flourish again, I am positive about our brands’ and the overall industry’s growth. The digitization of cultural experiences is here to stay given the successes this year and we will most likely see these coexist with the on-ground activities going forward.

What special initiatives has Bacardi planned this year?

At Bacardi, we identify and leverage consumer insights and needs in order to create any marketing initiative. We explore campaigns and activities where we have an organic fit, a right to play and ones that embody our brand spirit. Thus, with authenticity at the core, we will continue to create moments that matter through platforms, occasions as well as experiences; co-curating them along with our consumers, in formats they prefer.

What are Bacardi’s post-pandemic revival plans?

For us, as part of our BEST10 strategy, Bacardi, globally has been set with the task of making the next ten years the best ones for Bacardi, to become a company known to bring people together for exceptional drinking experiences. As part of this strategy, putting the consumer first and supporting our on-trade channels, especially at this time will be key elements. Our touch points to see this vision through will be authenticity, community and safety.

Authenticity will remain our pillar to build lasting consumer trust. As a family oriented company, we will continue to support communities and partners who’ve been impacted by the crisis. And as safety is crucial, we will continue to build creative but honest ways of ensuring safety.

Do you see the brand sales recovering from the Covid-19 setbacks in 2020?

Yes, I’m optimistic about the future. While distribution in on-trade is still on its path to recovery, we are positive that the new normal will take brand sales in a positive direction. The overall industry is expected to recover fully by the end of the year or early next year.

How do you see the Indian alcobev market recovering from the pandemic?

The growth signs are ushering in recovery in the industry. The channel that now requires innovative solutions to fully make a comeback and grow in the industry is the on-trade business. In this duration, e-commerce opened up for the alcobev industry and it would be interesting to see how it develops in the near future.

How are the Green Projects fairing, especially around packaging? The biodegradable bottles which does not leave behind harmful micro plastics. When is it scheduled to come to India?

In our over 158-year history, Bacardi has always been committed to respecting natural resources and acting responsibly, as well as inspiring consumers and peers to join us in these initiatives. In 2016, we committed to eliminate all single-use plastic straws in our cocktails globally. Now, we’re excited to pioneer the world’s most sustainable spirits bottle which is 100% biodegradable and make a giant leap forward in the fight against climate change and plastic pollution. It will be on shelf globally by 2023 and will replace 80 Million plastic bottles – 3,000 tons of plastic – currently produced by Bacardi across its portfolio of brands every year. Starting with Bacardí rum, the new packaging will be rolled out across the entire Bacardi supply chain and the company’s 200 brands and labels including Bombay Sapphire gin, Grey Goose vodka, Patrón tequila, Martini vermouth and Dewar’s Scotch whisky. We’re looking forward to share this exciting new biopolymer technology with the entire spirits industry.

This revolutionary move is in collaboration with Danimer Scientific, a leading developer and manufacturer of biodegradable products. Petroleum-based plastics used by Bacardi today will be replaced by Danimer Scientific’s Nodax PHA, a biopolymer which derives from the natural oils of plant seeds such as palm, canola and soy. While a regular plastic bottle takes over 400 years to decompose, the new spirits bottle made from Nodax PHA will biodegrade in a wide range of environments, including compost, soil, freshwater and sea water, and after 18 months disappear without leaving behind harmful microplastics.

Beam Suntory Reports 2020 Results

Beam Suntory, a leading global premium spirits company, reported full-year results for 2020.

Global net sales were flat for the year, as a return to growth in the second half offset lower sales in the first half of the year. Full-year sales grew 4% in the United States, as restaurant and bar activity improved in the second half and spirits continued to gain share from beer and wine. Sales were essentially flat in Japan, up at a single-digit rate in the UK and Russia, up high-single digits in Australia and Canada, and up double digits in Germany and South Korea. The impact of the pandemic led to lower sales in markets including Spain, India, China, South Africa and the Global Travel Retail channel.

Global sales for Jim Beam grew to surpass 11 million 9-litre equivalent cases for the first time, extending the brand’s leadership as the world’s number one Bourbon whiskey. Reflecting sustained consumer demand for premium brands, sales for Basil Hayden’s bourbon, Hornitos tequila, Toki whisky and Roku gin increased at double-digit rates. Sales were also exceptionally strong for Japanese ready-to-drink products and On The Rocks Premium Cocktails (acquired in September 2020), as consumer demand for convenience, refreshment and quality cocktails expanded.

“As we expected, consumer demand increased in the second half of 2020, even as the global pandemic continued to impact markets around the world,” said Albert Baladi, president & CEO of Beam Suntory. “I couldn’t be more proud of how our people adapted to confront the challenges of 2020 – from our frontline distillery workers to our sales teams, from our brand builders to every company function. As a result, we were able to meet consumers digitally in the emerging ‘home premise’ to support at-home cocktail-making and satisfy their expectations for convenience through increased investments in e-commerce and ready-to-drink products. At the same time, we supported our on-trade partners with innovations like cocktails to go, and guided by our vision of Growing for Good, we provided vital assistance to hard-hit restaurant and bar workers in markets around the world.”

“Looking ahead, the pace of recovery from the ongoing pandemic remains uncertain. In this environment, we expect to drive continued improvement in sales as we benefit from the strategic investments we made in 2020, the exciting brand plans we have in place, and our commitment to delivering quality to consumers at every step of the value chain up to the moment of consumption.”

Baladi also noted that Beam Suntory made substantial progress reducing its environmental impacts in 2020, and will soon announce a new global sustainability strategy featuring ambitious targets focussed on making a positive difference for nature, consumers and communities.

Update on Beam Suntory Growing for Good Initiatives

Environmental Sustainability

Carbon Reduction: Through the purchase of renewable electricity and the completion of multiple energy efficiency projects (Kentucky, Mexico and Scotland), Beam Suntory reduced its total Scope 1&2 carbon emissions by 25% compared to the 2015 baseline.

Water Efficiency: The company has reduced water use per unit of production by 29% (versus 2015 baseline) by optimising existing cooling systems and investing in more efficient cooling technologies at the Jim Beam distilleries in Kentucky.

Watershed Protection: The company has established Natural Water Sanctuary programmes at Maker’s Mark and adjacent to the Jim Beam distillery. The company continues to expand watershed protection activities to global manufacturing sites in India, Mexico, Spain, the US Virgin Islands and Ireland. Future activities are planned in Scotland, France and Canada.

Sanitizer: To support hospital systems and first responders in the fight against Covid-19, the company’s facilities in Kentucky, Japan, Spain, Scotland, Ireland, Canada and Mexico produced sanitizer sufficient to clean more than 50 million pairs of hands.

Hospitality industry: The company provided more than $3 million to support restaurant and bar workers and their families across numerous markets. Initiatives included Maker’s Mark’s partnership with the LEE Initiative Restaurant Reboot Relief Programme and Restaurant Workers Relief Programme, which donated more than 1 million meals to restaurant workers in the US, the company’s Shift-Meals To-Go programme supporting US hospitality workers and their families, and support programmes for on-trade workers in markets including Canada, the UK, Germany, Spain, Brazil and India.

February 2021

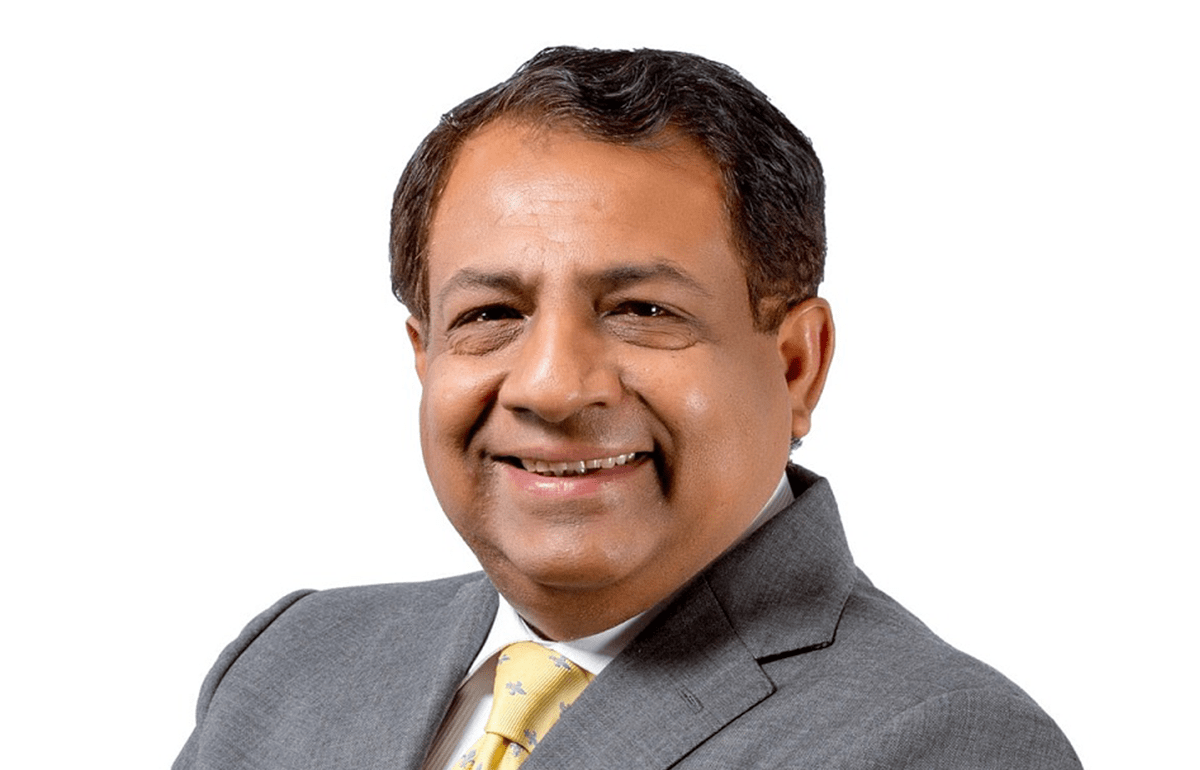

Diageo posts Interim Results

Encouraging return to growth, good cash generation and increased dividend

Diageo posted its Interim Results, half year ended on the 31st December 2020 showing encouraging results, both in India and Globally which has prompted a rationalization of their portfolio and paring of debt. The Interim Results stated that the net sales (£6.9 billion) were down by 4.5%, as the organic growth of 1% was more than offset by unfavourable exchange. The operating profit (£2.2 billion) also declined by 8.3% due to the unfavourable exchange and a decline in organic operating profit.

However the organic net sales were up by 1%, despite a significant impact from Travel Retail and on-trade restrictions. The net sales in North America were also up by 12.3%, offsetting declines in other regions, except for Africa which was broadly flat. The growth in North America was driven by resilient consumer demand, share growth of total beverage alcohol, positive category mix and the replenishment of stock levels by distributors and retailers.

The report also stated that the organic operating profit was down by 3.4%, driven by the channel and category mix. The productivity benefits from everyday cost efficiencies largely offset cost of goods sold inflation. The Net Cash from the operating activities was up by £0.7 billion to £2 billion, and free cash flow was also up from £0.8 billion to £1.8 billion.

This primarily reflected a lower tax payment and working capital benefit driven by reduced creditor balances at the end of fiscal 2020, as a result of reduced sales demand and cost control measures triggered in response to the Covid-19 pandemic. The Creditor balances also recovered to more normalised levels.

The Basic eps of 67.6 pence decreased 14.6%. Pre-exceptional eps declined 12.8% to 69.9 pence, driven primarily by unfavourable exchange and lower operating profit. However the interim dividend increased 2% to 27.96 pence per share.

The improvement comes from the strong sequential performance in all regions compared to the second half of fiscal 2020. However, the manufacturer expects continued impact in the second half of fiscal 21 from on-trade restrictions and disruption to Travel Retail.

Speaking about the results Ivan Menezes, Chief Executive, Diageo said, “We delivered a strong performance in a challenging operating environment, returning to top line organic sales growth during the half. North America, our largest market, performed particularly strongly and ahead of our expectations. Consumer demand has been resilient and the spirits category continues to gain share of total beverage alcohol. Across other regions we delivered strong sequential improvement compared to the second half of fiscal 20. This reflects improved market share performance through excellent execution in the off-trade channel, and the partial re-opening of the on-trade channel in certain markets.”

Menezes expects the ongoing volatility and disruption in the second half of the year, particularly in the on-trade channel, which will make performance more challenging. However the medium and long-term growth drivers and opportunities for the business remain intact and he is confident in the strategy, the resilience of the business and Diageo’s ability to emerge stronger. The organic operating margin improved compared to the second half of fiscal 2020 increased driven by the operating leverage and tight control of discretionary expenditure. The decline compared to the first half of fiscal 2020 reflected an adverse channel and portfolio mix. Menezes expects the margins to improve as the on-trade and Travel Retail recover and with the continued benefit of everyday efficiency.

Diageo India Results

In India, United Spirits reported strong numbers for the third quarter of 2020-21, even though the recovery was not as strong as expected. Despite the current operational challenges, the company was able to report Quarter-On-Quarter (QOQ) volume and revenue growth of 7% and 16% respectively and bring its third quarter revenues close to that of the same period last year. Though more than 85% of trade channels like bars, pubs, and clubs are now operational, they are operating at a low capacity which has impacted the results. Due to Covid protocols and muted celebrations, small gatherings are replacing large events. On the other hand, off trade channels like home consumption are in the upswing and home delivery is also gathering pace.

The third quarter Net Profit also zoomed 79% QOQ, mostly because of the reduction in debt and fall in interest rates. There was a QOQ increase in margin and once volume recovers fully, margin is expected to improve further due to stable input costs and expected price hikes. Price hikes are muted currently due to tough market environments. There was a demand impact in Bengal, where United Spirits was forced to increase prices for its popular brands due to increase in excise rates by the state government.

Despite small improvement in the Covid situation, large celebrations and full capacity in trade channels are still a few quarters away and that explains why liquor companies have not been able to participate in the recent market rally. However, analysts say that these are short to medium term challenges and the long term story on liquor consumption in India is still intact. To increase its market share during these difficult times, United Spirits is focusing on off-trade channels. Home delivery is already showing good traction in states like Bengal and Maharashtra and similar trend is expected from other key states as well.

Diageo strategic Review of Selected Popular Brands

United Spirits Ltd. (“USL”) is also initiating a strategic review of selected Popular brands, continuing the strategy towards long-term profitable growth through premiumising the company’s portfolio. USL’s Popular portfolio comprises around 30 brands and the strategic review will focus on approximately half of this portfolio by volume. This review will not include the McDowell’s or Director’s Special trademarks.

The strategic review is expected to be completed by the end of the 2021 calendar year. Anand Kripalu, Managing Director & CEO, United Spirits Ltd commented, “This review reinforces USL’s and Diageo’s commitment to deliver sustainable long-term growth and improved profitability, through a sharpened focus on core Popular, Prestige and above brands, including international brands.

United Spirits management is also taking steps to reduce its debt further by selling non-core assets and by improving its working capital cycle. United Spirits is a company with strong free cash flows which will contribute towards its plans to become a debt-free company by 2022-23 he added.

Alcohol consumption patterns in India

To start off, it has been assessed by the World Health Organisation that an individual consumes about 6.2 litres of alcohol per year. According to the World Health Organization (WHO), average alcohol consumption in India was 5.7 litres per person above the age of 15 per year in 2016, up from 4.3 litres in 2010. On per capita consumption, India is ranked 101 (with Moldova leading with 15.2 litres. In the immediate neighbourhood, the figure for Pakistan is 0.3 litres and China is 7.2 litres).

Moreover, about a third of India’s population consumes alcohol on a regular basis and 11% of the total number of Indians are moderate or heavy drinkers. One-third of males and one-fourth of females in India who have made it a part of their lives say, in surveys, that it causes problems to their physical health, finances and household responsibilities. But alcohol —the recent events have shown—is an intricate and essential part of the Indian economy.

Now let us evaluate state wise consumption of alcohol, measured in consumption per capita, per week in millilitres. For Toddy and country liquor, Andhra Pradesh and Telengana have the highest levels of consumption which drops to the lowest levels in states like Jammu and Kashmir, West Bengal, Maharashtra and Gujarat (for obvious reasons). The consumption in these states are as low as 100 ml per capita per week. Levels of Toddy consumption have seen a sharp decline in the northern state of Bihar as well, which still ranks in the medium to average range (101 – 500 ml. per capita per week).

Moving on to beer, imported wine and imported alcohol varieties, we see that Andhra Pradesh and Telangana still consume more than 300 ml. per capita, making those states the highest consumers in this category. Himachal Pradesh shows a sudden spike (101- 300 ml), and so do the north eastern states of Arunachal Pradesh and Mizoram and the islands of Andaman and Nicobar (>300 ml). Goa too, sees a high trend in this category, with the average between 101 and 300 ml per capita per week. The rest of the country remains quite conservative in their consumption trends of Indian Made Foreign Liquor (IMFL) varieties.

Overall, it has been observed that the Union Territories of Dadra and Nagar Haveli, Arunachal Pradesh, Andaman and Nicobar Islands, Andhra Pradesh, Telengana, Daman and Diu, Sikkim and Pondicherry are among the highest consumers of spirits and alcohol varieties in India.

Now one of the reasons why there has been greater number of calls for bans on alcohol in certain areas is due to the fact that these regions suffer from chronic alcoholism and resultant poverty. The regular consumption of any variety of alcohol and especially country made liquor has also been found to be inversely proportional to family income, thus providing further evidence for this trend.

Consumption of local brews and toddy is one of the major reasons for deaths in alcohol related incidents. In recent years, about 136 people were killed in one single incident. In January 2015, in a village in eastern Maharashtra, 94 people lost their lives due to hooch liquor contamination and resulting toxicity. The states that have prohibition in place presently are: Nagaland (since 1989), Manipur (since 1991, except the hill districts), Kerala (2014), Gujarat and Lakshadweep (on all islands except Bangaram).

India is one of the fastest growing alcohol markets in the world. Rapid increase in urban population, sizable middle class population with rising spending power, and a sound economy are certain significant reasons behind increase in consumption of alcohol in India.

Indian Alcohol Consumption – The Changing Behavior provides a comprehensive analysis of the market size of alcohol industry on the basis of type of products, consumption in different states, retail channel and imported and domestic. The Indian alcohol industry is segmented into IMFL (Indian made foreign liquor), IMIL (Indian made Indian liquor), wine, beer and imported alcohol. Imported alcohol has a meager share of around 0.8% in the Indian market. The heavy import duty and taxes levied raise the price of imported alcohol to a large extent. Alcohol is exempted from the taxation scheme of GST.

The Indian alcohol market is growing at a CAGR of 8.8% and it is expected to reach 16.8 billion liters of consumption by the year 2022. The popularity of wine and vodka is increasing at a remarkable CAGR of 21.8% and 22.8% respectively. India is the largest consumer of whiskey in the world and it constitutes about 60% of the IMFL market.

Though India is one of the largest consumers of alcohol in the world owing to its huge population, the per capita alcohol consumption of India is very low as compared to the Western countries. The per capita consumption of alcohol per week for the year 2016 was estimated at 147.3 ml and it is expected to grow at a CAGR of 7.5% to 227.1 ml according to estimates.

The states of Andhra Pradesh, Telangana, Kerala, Karnataka, Sikkim, Haryana and Himachal Pradesh are amongst the largest consumers of alcohol in India. The most popular channel of alcohol sale in India is liquor stores as alcohol consumption is primarily an outdoor activity and supermarkets and malls are present only in the tier I and tier II cities of India.

The trends and pattern of alcohol consumption are changing in the country. With the increasing acceptance of women consuming alcohol, growing popularity of wine and high demand for expensive liquor, the market scenario seems to be very optimistic in the near future.

The study reflected changing pattern of the consumer’s mindset towards alcohol consumption in India. 3% of the respondents who consumed alcohol favoured wine for its health benefits. Though the popularity of whisky is highest in the Indian market, its market share is expected to decrease in future.

Alcohol consumption in high-income countries witnessed constant growth, but it has been growing in low and middle-income countries as well. Before 1990, Europe had recorded the highest level of alcohol use. However, the study forecasts that Europe will not hold that title for long.

Going ahead, the world will drink more, and more people will drink as well. The research also suggests that almost half the adults across the world will consume alcohol by 2030, whereas a quarter of them will become binge drinkers.

Binge drinkers are those people who drink 60 grammes or more pure alcohol in one or more sittings, in a month.

Starting Young

Indians are not just drinking more, they are drinking dangerously as well. As many as 57 million people are facing the after-effects of alcohol addiction. A survey by the Community Against Drunken Driving (CADD) revealed that over 88% of youth below 25, consume or purchase alcohol though it’s illegal. Punjab, Goa, Tripura, Chhattisgarh and Arunachal Pradesh rank high on alcohol consumption. However, Uttar Pradesh has the highest number of alcohol drinkers in India.

Regulating alcohol

A few state governments like Bihar, Gujarat, Mizoram and Nagaland, have prohibited the sale of alcohol. States like Kerala, Bihar, Tamil Nadu have imposed variety prohibition since 2016. The state government of Rajasthan allows sale of liquor only until 8.30 in the evening. India has also witnessed an increase in the number of drunken driving cases. According to reports, fines from drunk driving in India in 2018 alone, was at around `6 crore.

Assam is the highest alcohol consuming state in India

In the 15-54 age group, with 59.4%, men from Assam were found to be the highest consumer of alcohol in the country. In the latest Health and Family Welfare Statistics (HFWS) in India, it has been reported that 26.3% of women and 59.4% of men between 15-54 years of age consume alcohol in Assam. This is the highest in the country and the national percentages for the same age group are respectively 1.2 and 29.5. However, in terms of percentage of the population for both men and women in the age group 15-49 years who drink alcohol about once a week out of a total population (men and women) who drink alcohol, Assam women scored 44.8% and men scored 51.9% Meanwhile, in the 15-54 age group for women, Nagaland, Himachal Pradesh, Goa, and Karnataka recorded the lowest alcohol consumption with 0.1%. In the same category for women, Jammu & Kashmir occupies the second position with 23% women found to be consuming alcohol. In the 15-49 age group, with 59%, men from Arunachal Pradesh were found to be the highest consumer of alcohol in the country. The HFWS report further revealed that percentage of the population of men and women in the 15-49 years who drink alcohol about once a week was found to be 45.2% and 55.1% respectively for women and men of Arunachal Pradesh. For women and men in Nagaland, the percentage of the population who drink alcohol about once a week in the 15-49 age group was found to be 65.5% and 46.4% respectively. As for the other states from the northeast, the percentage of the population of men and women in the 15-49 years who drink alcohol about once a week are – Manipur 21.3% and 40.1%; 25.1% and 42.4%; Mizoram 20.3% and 41.2%; Nagaland 65.5% and 46.4%; Sikkim 33.9% and 43.5% and Tripura 50.8% and 47.1%. The five southern states of Andhra Pradesh, Telangana, Tamil Nadu, Karnataka and Kerala together consume as much as 45% of all liquor sold in the country. The financial position of these states is precarious as the Coronavirus lockdown completely dried up this crucial liquidity tap for them in April. Although these states consume as much as 45% of all liquor sold in the country annually. Not a drop was sold in April, and given the dire state of their revenues, these states have been anxious to make good the losses by opening up the vends, said the survey. While Tamil Nadu and Kerala top the list in revenue percentage terms at 15% each, for Kerala the tax on liquor is its single largest revenue source. The revenue share is 11% each for Karnataka and Andhra Pradesh and 10% for Telangana, shows the report. Delhi is at number three when it comes to liquor revenue share with 12% of tax revenue, but its citizens swig only 4% of the national intake. Tamil Nadu has another distinction – it is the single largest consumer of liquor in the country, guzzling as much 13% of national sales, closely followed by Karnataka with 12%. Andhra quaffs 7% of the national intake, followed by Telangana (6%) and Kerala (5%). While all other states have high population, when it comes to Kerala, despite being home to only 3.3 crore people, it draws the highest revenue because among the five states it charges the highest tax rate on liquor. However nationally, Maharashtra charges the highest rate, but draws only 8% of its tax revenue from liquor – primarily because it is the most industrialised state and has many other sources of income – and also consumes only 8% of the national intake despite being the second most populous state. Twelve states – the five southern ones, Delhi, Punjab, Uttar Pradesh, West Bengal, Madhya Pradesh and Rajasthan – account for 75% of liquor consumption in the country. But uncorking the bottled spirit will also be a problem for these 12 states as they contribute to more than 85% of all Covid-19 infections/deaths as well. Among these 12 states, Kerala has the lowest national average in this at under-1%, the report said. You might associate Goa with booze and partying, but a higher proportion of people in Telangana consume alcohol than in the former. And a larger percentage of men drink in Bihar, a state under prohibition, than in Maharashtra. Gujarat and Jammu & Kashmir, in that order, have the least consumption of alcohol among men. When it comes to women’s consumption of alcohol, Sikkim and Assam, with 16.2% and 7.3%, respectively, top the charts. But here, too, Telangana comes next, topping Goa. Barring Telangana and Goa, most of the states at the top are in the northeast. The consumption among rural women is significantly higher than in urban areas in most states, which could also be due to less hesitation in admitting to alcohol consumption compared to urban women. This difference in prevalence of alcohol consumption exists between rural and urban men too, but the difference is not as high as among women. Covid-19 may change many aspects of work, life and the economy, but India’s relationship with alcohol will likely remain intact. If anything, the linkages might get stronger. When the pandemic-induced lockdown was first announced, the Centre excluded liquor shops in the category of establishments that would stay open. It was not deemed to be “essential”. States backed the Centre’s stance. But as the days under the lockdown accumulated, and as the economy and tax collections slumped (with more money from the Centre not forthcoming), states started clamouring with the Centre to allow liquor vends to reopen.

State controls

India has had a conflicting history with prohibition. States have been torn between the need for revenues and the broader problems its abuse created. As a result, they have been imposing dry days, and some form of control. Some states have gone the full hog in imposing prohibition: Gujarat (since 1960), Nagaland (since 1989), Bihar (since 2016), Mizoram (since 2019), and in most parts of Lakshadweep. In most parts, states control liquor distribution. Take, for example, TASMAC (Tamil Nadu State Marketing Corporation), set up in 1983 by then-chief minister M.G. Ramachandran as the monopoly liquor wholesaler for better control over distribution. For retail, it auctioned licences to the private sector. This, in turn, led to problems, including cartelisation and customer complaints – and lower revenues to the state. Twenty years later, the J. Jayalalithaa government claimed monopoly over retailing too. It has served the state well. Its revenues jumped from `2,828 crore in 2002-03 to `31,157 crore in 2018-19. It’s also a reason why Tamil Nadu has been pushing the Centre to reopen liquor shops. Unlike the purchase of a car or a computer, lost liquor sale is lost forever. Thus, for TASMAC, which was selling 160,000 cases of Indian-made foreign liquor and 90,000 cases of beer every day, the sales might not necessarily return, reducing the ability of Tamil Nadu to fund even ongoing schemes. The time has come to ‘de-criminalise’ liquor as the state of Goa has done successfully. Considering that 50% or more of the price of every bottle finds its way to the coffers of state governments, it is preposterous that tipplers are treated with such scant respect.

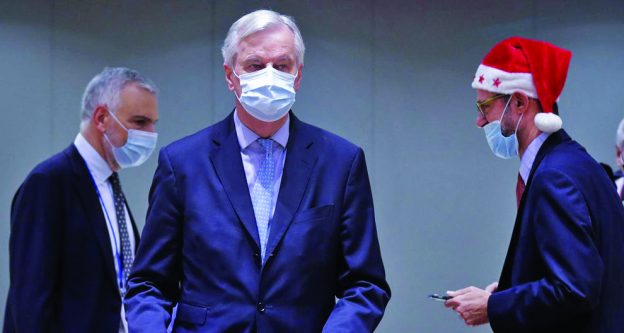

Brexit deal scrutiny begins as trade document published

Commenting as the UK and EU agreed a free trade deal, Scotch Whisky Association Chief Executive Karen Betts said: “It’s very good news that the UK and EU have agreed a free trade deal, providing Scotch Whisky producers with more certainty about how we continue to export to our largest regional market. “We will now need a common-sense approach to the application of new rules and new border procedures from 1 January to help businesses manage the transition smoothly. The UK Government and EU Member States will need to be flexible with producers, logistics companies and importers as they get to grips with the significant changes that will take effect in just 7 days’ time.” Legal experts and MPs were poring over the 1,246-page document published on the morning of Boxing Day, as Boris Johnson worked to persuade Eurosceptic Tories to back it as the “right deal” for the country.

The Prime Minister acknowledged to Conservative MPs that “the devil is in the detail” but insisted it would stand up to inspection from the European Research Group (ERG) of Brexiteers, who will assemble a panel of lawyers to examine the full text ahead of a Commons vote. But the chief executive of the National Federation of Fishermen’s Organisation, Barrie Deas, accused Mr Johnson of having “bottled it” on fishing quotas to secure only “a fraction of what the UK has a right to under international law”.

The share of fish in British waters that the UK can catch will rise from about half now to two-thirds by the end of the five-and-a-half-year transition. The EU’s 27 member states indicated they will formally back the deal agreed by the UK with Brussels’ officials within days. It covers trade worth about £660 billion and means goods can be sold without tariffs or quotas in the EU market. EU ambassadors were briefed on the contents of the deal by Michel Barnier, who led Brussels’ negotiating team in the talks with the UK.

After a highly unusual meeting on Christmas Day – with at least one diplomat wearing a Santa hat and another in a festive jumper – they agreed to write to the European Parliament to say they intend to take a decision on the provisional application of the deal. The timing of the Christmas Eve deal forced politicians and officials in the UK and Brussels to tear up their plans. MPs and peers will be called back to Westminster on December 30 to vote on the deal, but MEPs are not expected to approve it until the new year, meaning it will have to apply provisionally until they give it the green light. The agreement will almost certainly be passed by Parliament, with Labour supporting it, as the alternative would be a chaotic no-deal situation on January 1.

But Mr Johnson is keen to retain the support of the Eurosceptics on his benches who helped him reach No 10. Mr Johnson had earlier messaged Tory MPs on WhatsApp as he tried to get them all on side. “I truly believe this is the right deal for the UK and the EU,” he wrote, in a message seen by the PA news agency. “We have delivered on every one of our manifesto commitments: control of money, borders, laws, fish and all the rest. “But even more important, I believe we now have a basis for long-term friendship and partnership with the EU as sovereign equals.” He added that “I know the devil is in the detail” but the deal will survive “ruthless” scrutiny from the “star chamber legal eagles” The “star chamber” is the nickname given to the panel assembled by the ERG, including veteran Eurosceptic Sir Bill Cash. Officials in Brussels and the capitals of EU states are also beginning to scrutinise the deal, with another meeting of ambassadors expected before the new year, possibly on December 28.

The European Commission has also announced a £4.5 billion fund to help regions and industries within the bloc which will be hit by the UK’s withdrawal from the single market and customs union – including fishing communities who face losing out as the UK takes a greater share of stock in British waters. French Europe minister Clement Beaune said it was a “good agreement” and stressed the EU had not accepted a deal “at all costs”. Mr Beaune said that British food and industrial products entering the European single market after January 1 will not pay customs duties “but will have to meet all our standards”.