Uttar Pradesh became the first state to announce its excise policy for the year 2022-23, setting an excise revenue target of Rs. 40,000 crore, up from Rs. 34,500 crore in the previous year. To achieve the target, one of the routes the UP government has taken is to increase the license fee across all categories. The increase ranges from 20% to a whopping 172%, depending upon the nature of license.

Revenue Target

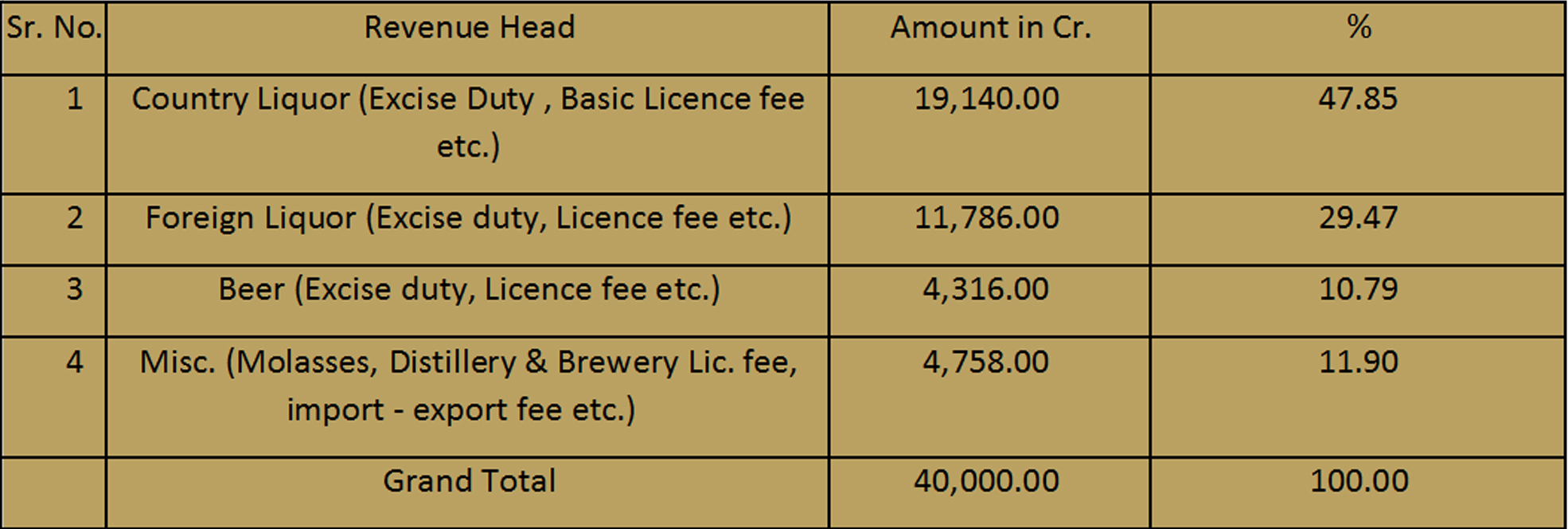

The UP government collects 20% of its annual revenue from excise, however in the last two years, due to Covid, there has been a dip in the collection of excise from the set targets. In 2020 -21 targetted revenue was `37,500 crore which was reduced to Rs. 34,500 crore in the current financial year (21 -22) against which by this year end the expected revenue collection is Rs. 36,000 crore. Considering the positive trends and situation becoming normal the UP government has fixed an optimistic revenue of Rs. 40,000 crore. This is 16% more than the revenue target of 2021-22. The breakup of revenue planned for 22-23 is shown below :

Avenues for Revenue

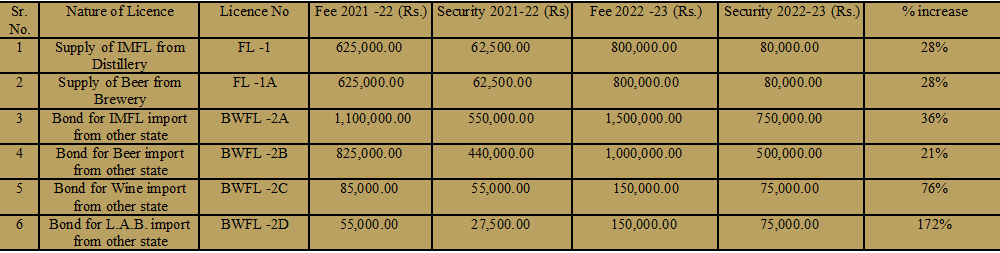

Licence Fee

To achieve Rs. 40,000 crore, it has increased the licence fee and security amount across all categories of licences. Some of these licences are shown below:

Besides the above mentioned increase, the processing fee for these licences has been increased to `1.0 lac as against Rs. 55,000 for each application.

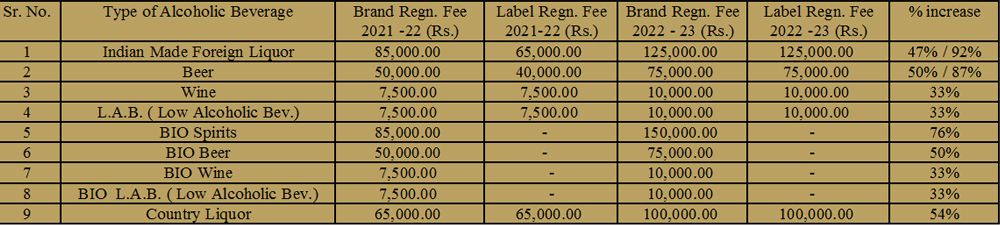

Brand & Label Registration Fee

Label registration is very tedious work which the entire beverages alcohol industry has to indulge in every year by compromising manufacturing and supplies till new labels are registered. Manufacturers spend a good amount of productivity of its people besides paying the stipulated fee. The industry feels it is difficult to understand the reason for this increase every year. Under the new excise policy, this fee has been increased from 33% to 90%.

Excise Duty

There is a very nominal increase in the Pratifal fee of IMFL. This increase will be between 0.75% – 1.50% maximum per case of 9 litre depending upon the Liquor category (Economy, Medium, Regular, Premium etc.). Similarly for beer the Pratifal fee has been increased by Rs. 1 per litre. At least this is a relief to the industry which has a direct impact on fixation on MRP.

Country Liquor – The Milking Cow

Due to high sales, massive production stakes with minimal import allowed from outside state, country liquor (CL) has always been top priority for various state excise departments. CL’s contribution in overall excise revenue ranges between 45% – 50% every year and therefore a lot of effort is made to safeguard this major chunk of revenue. The UP excise has therefore initiated following steps to ensure its revenue of Rs. 19,140 cr. for the fiscal 2022 -23;

- Reducing MRP by Rs. 5 per unit of 200 ML

- Removal of Covid cess

a) Not increasing the excise duty - Removing 42.8% v/v MASALA CL . Now there will be only two types of MASALA CL i.e. 36% & 25% v/v

- However 42.8% v/v UPML shall continue to sell at reduced MRP

It is very interesting to note that the same UP Govt and state excise department which had become very strict on changing the packaging norms of country liquor last year has changed its decision in just a couple of months . After two subsequent hooch tragedies in western UP in early 2021, the alternatives of the CL in PET bottle were being discussed at high levels of government and in the months of July – August 21 pressure was mounted on the industry to source aseptic brick carton filling machines aka Tetra Pack machine since this kind of packing is considered as 100% tamper proof. In fact few circulars were issued to industry to start supplying at least 20% of CL in Tetra Pack immediately. There was much hue & cry in UP’s distillery sector because there is hardly any manufacturer of this type of filling machine in India and import of this machine can take minimum 90 – 120 days’ time. In the new excise policy this condition has been replaced from Tetra pack to glass bottle packing having a shrink wrap on the cap. This will certainly give a boost to Firozabad (UP) glass industry which has been requesting the government to provide a platform for its revival.

Wine: Still a Mirage

The total excise revenue generated through wine sales in 20 -21 was only Rs. 9.68 crore out of total revenue generated of approx. Rs. 30,000 crore. Wine’s revenue contribution increased to Rs. 29.54 crore in 2021-22 of Rs. 34,500 crore. The growth in wine sales in UP has phenomenally increased by 200% in just one year which clearly shows the scope and opportunities for wines. The increase of revenue is directly proportional to consumption.

At the moment there is not a single winery in UP and to boost the wine industry the government is continuing with its endeavour as provided in its last years excise policy by :

- Exempting wines produced in UP from all types of excise duty & levy for a period of another four years

- Allowing vintner to sell wine in a store inside the winery by paying a small annual fee of `50,000 for a year

- Allowing wine taverns inside the winery.

- A licence fee of Rs. 57,500 for establishing a winery in UP

The new excise policy also indicates towards a separate new wine policy being prepared. It is suggested that the UP government establish a wine promotion board on the lines of the Karnataka Wine Board which is headed by a knowledgeable and senior IAS officer and other administrative officers who closely work with wine industry to find our more and more avenues for increasing wine production and consumption. Associations and federations like the Indian Wine Academy should also come forward to tap this potential.

Ease of Doing Business

We can see some steps the U.P. government is taking for ease of doing business in the excise policy. Some of these initiatives are:

- Annual licence fee for home/personal possession of liquor licence has been reduced to Rs. 11,000 from Rs. 12,000 from last year and the refundable security amount has also been reduced to Rs. 25,000 from earlier Rs. 51,000.

- Wine manufacturing and selling soaps as mentioned.

- No increase in bar licence fee.

- Microbrewery can sell/supply craft beer in 50 litre kegs.

- Wholesale licence can store stocks w. e. f. 15th Feb.22 meant for next excise year.

- Renewal of retail shops is permitted.

- No increase in any licence fee and excise duty for defense forces establishments in UP.

- Rs. 50,000 will be given as discount on the licence fee if bar & microbrewery both licences are applied simultaneously.

- Track & Trace system to be extended to the retail sales.

Analysis By: Gopal Joshi

Strategist & Consultant

Beverages Alcohol Industry

linkedin.com/in/gopal-joshi-78a2a33

Hamko beer shop open karna he uske liye licence hamko chahiye 9839202227 Lucknow se cantt Lucknow

I have licence for. Wine Shop

How to apply

Best in utar Pradesh

I want open a wine shop and beer shop

I want beer bar licence?

Mai bhi bar & resto ka licence chahta hu